Boston Mayor Michelle Wu is seeking a temporary hike in commercial property taxes, a move designed to fill the city’s budget gap without creating a greater tax burden on homeowners.

A recent data analysis determined the city risks losing more than $1 billion in tax revenue over the next five years. Wu has opposed cutting municipal spending, while raising homeowner property taxes could alienate her constituents.

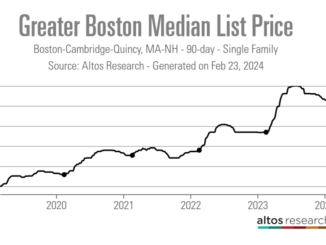

According to combined media reports, more than one-third of Boston’s tax revenues comes from commercial properties. However, the vacancy rate for Boston’s office properties is near a record high of 25%. There is a precedent in Boston for raising commercial property taxes during an economic rough patch – a similar action occurred nearly a quarter-century ago during the dot-com bubble crisis, but a recovery from that crisis was considered inevitable, whereas today’s vacancies are burdened with the remote work trend that began during the pandemic and has become something of a new normal.

Wu insisted she had no choice but to pursue this strategy.

“Nearly three quarters of the city budget comes from property taxes,” she said. “We are asking for the ability to protect our residents. If we do nothing, there is a chance that residential rates would go up significantly, and that is what we’re trying to avoid.”

But Wu’s proposal was criticized by Mitchell Moss, a New York University urban policy and planning professor, who warned office tenants facing higher taxes could leave Boston.

“You don’t raise taxes on an industry which is suffering because you’re going to make it less competitive,” said Moss.