The U.S. Dollar, as measured by the DXY index, started the week on a positive note, rallying more than 0.65% to 102.75, bolstered by risk-off sentiment and higher U.S. treasury rates in a session characterized by thinner liquidity and lower trading volume, with European markets closed for the Easter Holiday.

Bond yields extended their recovery that began Friday after the latest U.S. nonfarm payrolls report showed that job gains remained remarkably strong last month, with U.S. employers adding 236,000 workers versus 239,000 expected, despite growing macro headwinds, including more restrictive credit conditions for households and businesses.

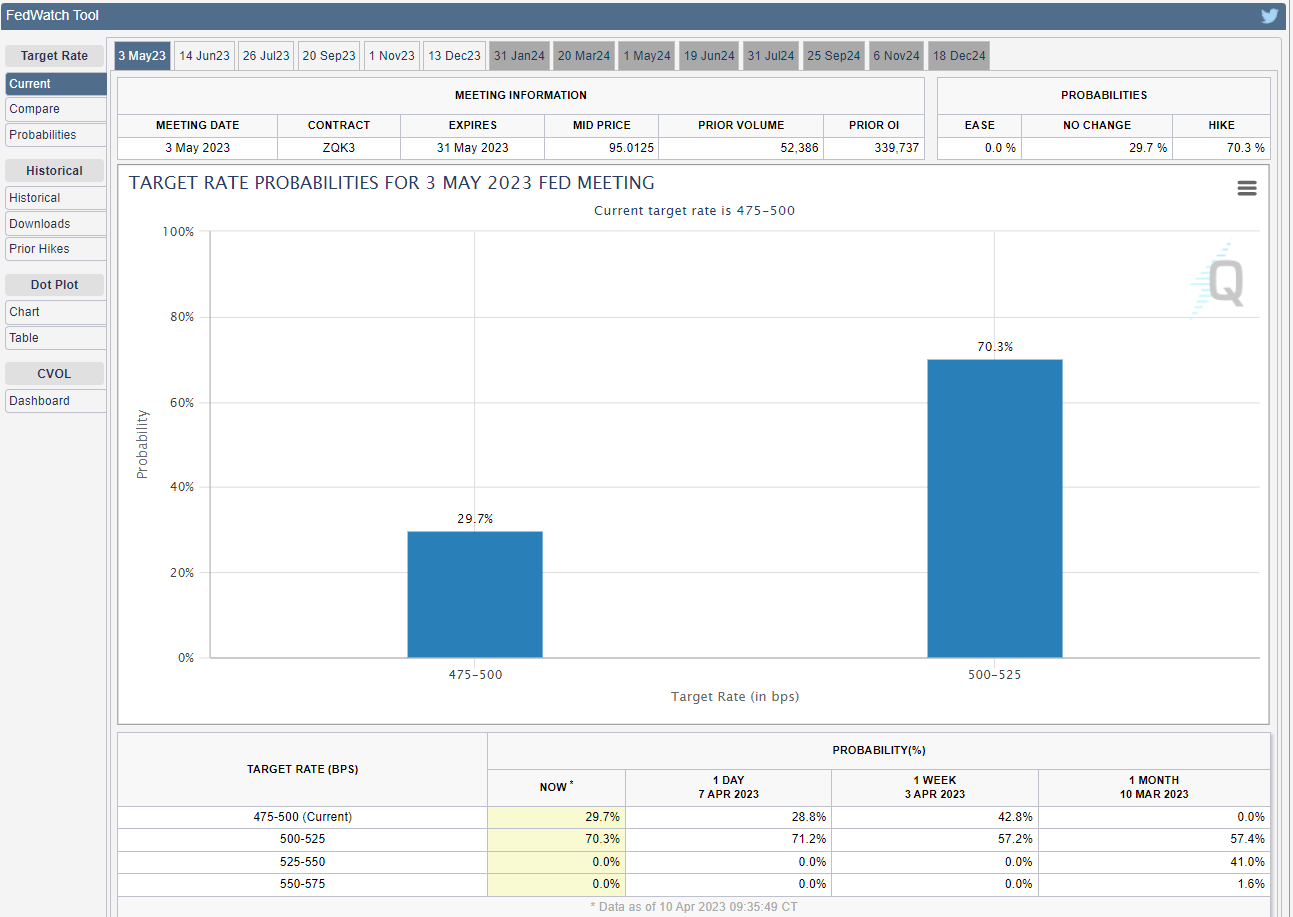

Labor market tightness may give the Fed ammunition to continue lifting borrowing costs in the near term, suggesting that a “pause” may not yet be in the cards for May. In fact, traders now see more than a 70% chance of a 25 bp hike at next month’s FOMC meeting, up sharply from 10 days ago, when the baseline scenario assumed no change.

FEDWATCH TOOL AT A GLANCE

Source: CME Group

Although investors appear to be leaning in favor of a continuation of the Fed’s tightening campaign, the likelihood of a pause should not be underestimated, especially since March employment results may be overstating strength by not fully capturing the impact of the banking sector turmoil that led to the failure of two regional banks.

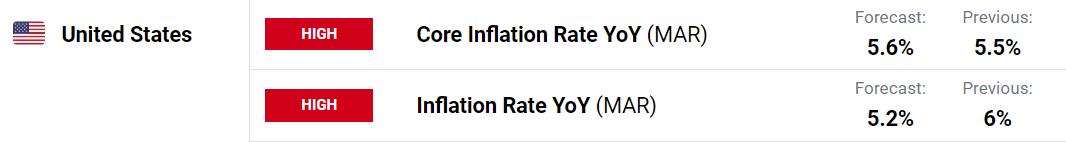

To better predict the central bank’s next steps, incoming data will have to be closely watched, particularly the March inflation report, which will be released on Wednesday. In terms of estimates, headline CPI is forecast to have slowed to 5.1% y/y from 6.0% y/y previously, but the core gauge is seen ticking up to 5.6% y/y from 5.5% y/y in February.

INFLATION DATA EXPECTATIONS

Source: DailyFX Economic Calendar

For monetary policy expectations to shift in a more dovish direction, markets would need inflation metrics to surprise on the downside and show compelling signs of downshifting across categories. This scenario should not be ruled out entirely, given recent price dynamics.

On the flip side, if inflationary forces fail to weaken materially and price pressures remain sticky, all bets are off. This could lead traders to bet on additional rate hikes beyond the May meeting, pricing in a slightly higher peak rate and ruling out cuts for the second half of this year. This would be bullish for the U.S. dollar.

US DOLLAR TECHNICAL OUTLOOK

The U.S. dollar has resumed its rebound and seems on its way to challenging its 50-day simple moving average near 103.40. If prices manage to overtake this technical barrier, buying momentum could accelerate, paving the way for a move toward trendline resistance at 104.50. Conversely, if sellers regain control of the market and trigger a bearish reversal, initial support rests at 102.02, the 50% Fib retracement of the January 2021/September 2022 advance. If this floor is breached, the focus shifts to the February lows at 100.82.

US DOLLAR (DXY) TECHNICAL CHART

Source: www.dailyfx.com