New data from data analytics companies shows real estate investors have been buying up more of the housing market in the last few years than ever before.

According to Pew Charitable Trusts, a non-partisan and non-ideological research organization based in Philadelphia, investors bought 24% of single-family homes purchased in 2021. Since 2012, that number has been between 15% and 16%, making 2021 the fastest “year over year increase in 16 years.”

In 2022, that number peaked at 28% of single-family home purchases.

“There are billions of dollars, trillions of dollars, just sloshing around in the economy looking for places to go. Where do we go, what are we going to invest in? Real estate is a really, really good investment,” said Mike DelPrete, a global real estate tech strategist and scholar at the University of Colorado Boulder. “It’s definitely an issue worth paying attention to.”

Real estate investing has always been a part of the housing market, but the roots of the “corporate investor” came out of the 2008 housing crisis when there were mass foreclosures across the United States.

“It’s a bipartisan issue in terms of the concern that Democrats and Republicans have expressed,” said Jordan Ash, a member of the Private Equity Stakeholder Project. “It’s because it really is directly impacting people’s ability to achieve the American Dream — that people are being shut out.”

According to CoreLogic, a data firm that analyzes financial and property information, only 15% of homes purchased by investors in March of 2022 were resold within the following six months.

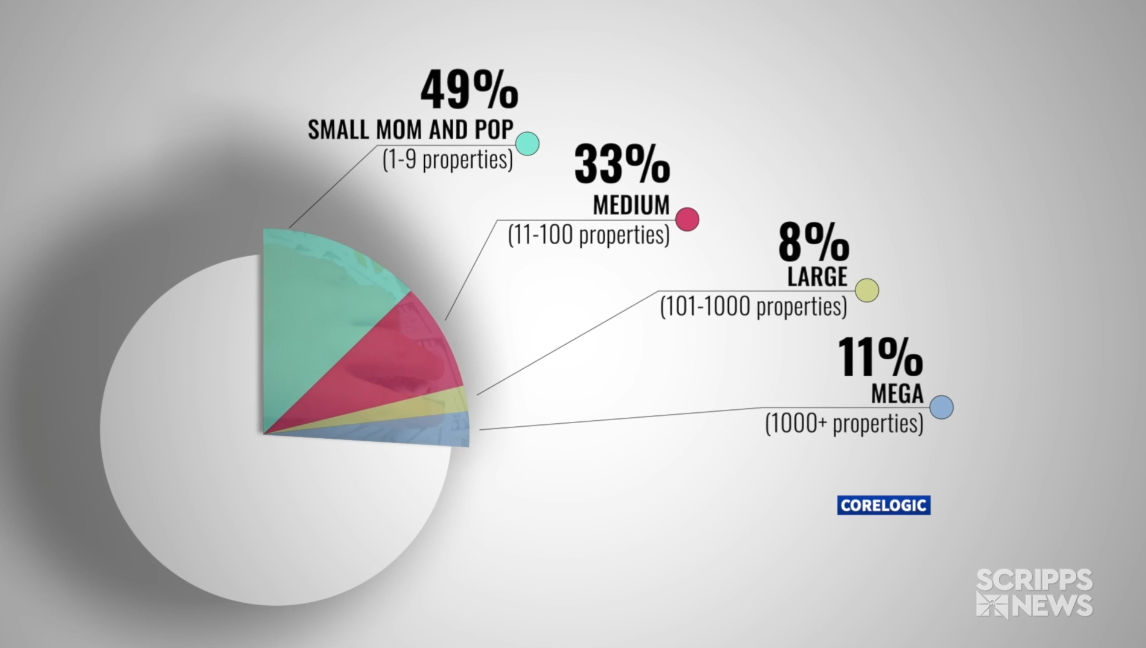

It’s worth showing how these investors are splitting this pie.

The CoreLogic data shows of the 26% of homes that were purchased by investors in the third quarter of 2022- 49% were small mom and pop investors (fewer than 10 properties), 33% were medium-sized investors (11-100 properties), 8% were large investors (101-1,000 properties) and 11% were mega investors: companies that own more than 1,000 properties.

“At its very base, it’s going to make it more difficult for buyers to buy homes because people like you and I — if we’re looking to buy a home in Atlanta or Phoenix, or any of these markets, we’re competing against institutional buyers,” said DelPrete. “They are, by definition, cash buyers. They don’t have mortgages; they don’t have contingencies; they’ve got briefcases full of cash, ready to go. And their job — the people you’re bidding against — their job is to buy houses. So, who do you think is going to win that bidding war? It’s going to keep going back to the institutional investors.”

We reached out to Progress Residential for comment, as it boasts more than 85,000 properties across the country. They declined to comment and sent us to the National Rental Home Council instead, a trade group that represents some of our country’s largest corporate investors. In an email, its president, David Howard, said, “Any narrative around the role of institutions that own single-family rental homes needs to begin with the fact that these companies (that own more than 1,000 properties) account for less than one-third of one percent of all the housing in the United States.”

However small, Ash is still wary of how much of an impact these mega investors may really have on the housing market.

“There are entire communities that are now kind of being shut out, where these corporate landlords are basically extracting the money that would’ve been for individual families being able to build equity,” said Ash.

In late October, three Democratic House members from California introduced the Stop Wall Street Landlords Act, which would deny certain tax benefits to investors whose assets exceed $100 million a year.

States legislators in Ohio, North Carolina, Georgia and Arizona have also introduced their own bills since December that would limit the amount of homes investment companies could purchase.

“This is a very nuanced [issue],” said DelPrete. “You know, institutional investors, on the other side; they’re a backstop to the entire housing market. When people can’t afford to buy and sell houses, they’re there, they’re buying. That is important.”

Source: scrippsnews.com