UK Homeowners Facing Mortgage Rates Over 5%

Unlike the U.S., mortgage borrowers in the U.K. are required to renew mortgages on a cyclical basis. The post UK Homeowners Facing Mortgage Rates Over 5% appeared first on Weekly Real Estate News.

Unlike the U.S., mortgage borrowers in the U.K. are required to renew mortgages on a cyclical basis. The post UK Homeowners Facing Mortgage Rates Over 5% appeared first on Weekly Real Estate News.

The average rate on the popular 30-year fixed mortgage crossed over 7% on Tuesday, according to Mortgage News Daily. That is the highest level since early March. Rates have been rising on a combination of […]

LONDON, March 22 (Reuters) – British inflation unexpectedly rose to 10.4% in February, pushed up by higher food and drink prices in pubs and restaurants, according to official data which is likely to prompt the […]

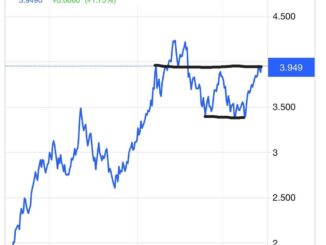

What a week this has been for the housing market, from the fireworks of Fed Chair Jay Powell’s Congressional testimony to an attempt to break over a critical line on the 10-year yield. Then Friday […]

US stocks stocks were mixed on Thursday as traders continue to mull the prospect of higher interest rates amid signs the economy remains in high gear. All three major indexes were on track for a […]

The volume of mortgage application activity for both refinancing and purchasing fell again last week. The Mortgage Bankers Association (MBA) said its Market Composite Index, a measure of application volume, decreased 5.7 percent on a […]

The post FHA Cuts Mortgage Insurance Rates, Providing More Opportunity for First-Time and Low-Income Buyers appeared first on Weekly Real Estate News.

The average rate on a 30-year fixed mortgage surged nearly a quarter-point to 6.96% this week, looming closer to the 7% benchmark that hasn’t been reached since November. This marks the third consecutive week of […]

Washington CNN — Mortgage rates shot up for the third-straight week, as inflation concerns make rates more volatile. The 30-year fixed-rate mortgage averaged 6.5% in the week ending February 23, up from 6.32% the week before, […]

WASHINGTON, Feb 22 (Reuters) – Nearly all Federal Reserve policymakers rallied behind a decision to further slow the pace of interest rate hikes at the U.S. central bank’s last policy meeting, but also indicated that […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes