Have mortgage rates peaked for this cycle?

After mortgage rates spiked to 8% in October, causing a riot in the real estate industry, we had an epic move lower in mortgage rates last week. Does this mean we’ve hit the peak in […]

After mortgage rates spiked to 8% in October, causing a riot in the real estate industry, we had an epic move lower in mortgage rates last week. Does this mean we’ve hit the peak in […]

The jobs report today which should move mortgage rates lower, demonstrates why it’s time for the Federal Reserve to land the plane. The labor market doesn’t show wages spiraling out of control as it did […]

While existing homebuyers have been battling high mortgage rates for months — which are now at 8% — the builders are wooing buyers with lower rates and incentives. Today, the new home sales data beat […]

The haunted house ride with the bond market and mortgage rates continued this week, but one housing data line hasn’t been spooked. New listing data appears unafraid of the mortgage rate ghost story over the […]

With mortgage rates nearly touching 8%, builder confidence dropped four points in October, falling to its lowest point since January 2023, the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) reported on […]

CEDAR CREEK, Texas — At HousingWire Annual on Tuesday, HousingWire Lead Analyst Logan Mohtashami demystified “the madness” unfolding in the bonds market in front of an audience of more than 400 real estate and mortgage […]

Mortgage rates kept climbing this week as spreads on the 10-year Treasury yield widened, reaching a 16-year high. Freddie Mac‘s Primary Mortgage Market Survey, which focuses on conventional and conforming loans with a 20% down […]

In an environment where 30-year fixed mortgage rates are racing towards 8%, loan officer pipelines are thinning dramatically. Originators who primarily served move-up buyers with high credit scores and strong down payments are struggling to […]

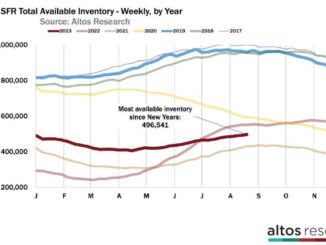

Mortgage rates only kept climbing in the last week. Buyers in this real estate market notice these affordability changes, and so we can see in the data fewer home purchase offers, slightly climbing unsold inventory, […]

KEY TAKEAWAYS The average rate on a 30-year mortgage has risen to a 21-year high, putting more pressure on homebuyers. Home prices have stayed resilient even amid higher mortgage rates because the low number of […]

Copyright © 2024 | MH Magazine WordPress Theme by MH Themes