Inflation and Fed day: A crucial moment for the housing market

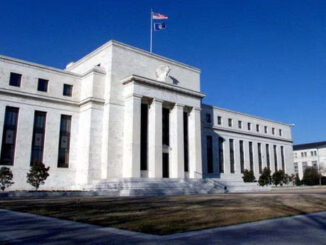

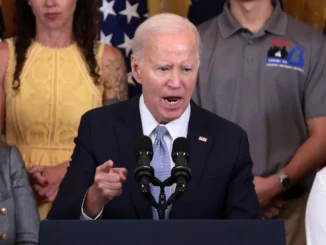

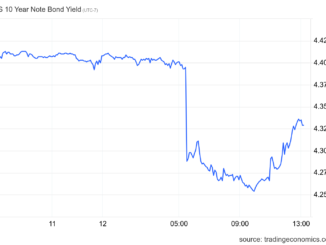

Today’s double event of the CPI inflation report and the Fed meeting gave us something that I have been waiting for: a hint from Fed Chairman Jay Powell that the labor market has softened. […]