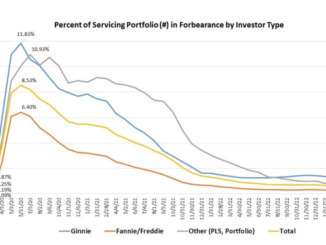

MBA: Only 0.23% of Loans in Forbearance at the End of 2023

The Mortgage Bankers Association (MBA) reported the total number of loans now in forbearance decreased by 3 basis points to 0.23% as of Dec. 31. According to MBA’s estimate, 115,000 homeowners are in forbearance plans. […]