UK mortgage rates rise again, turning screw on homeowners and buyers

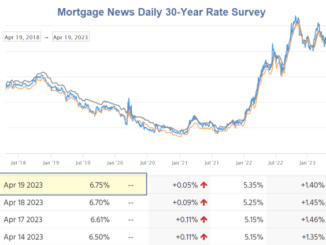

LONDON, June 29 (Reuters) – Major British lenders on Thursday announced another increase in mortgage rates offered via brokers, pushing many products above the 6% mark in painful news for many homeowners and potential buyers. […]