Builders cheer up as mortgage rates fall

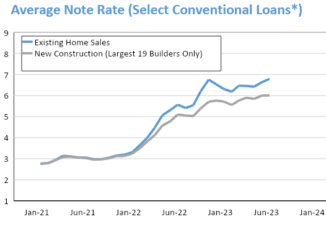

A decline in mortgage rates since November helped end four months of declines in builder confidence. Recent economic readings suggest improving housing conditions in 2024. Builder confidence gained three points to 37 in December, the […]