Persistent Inflation Hammered Pending Home Sales in September, Falling 10%

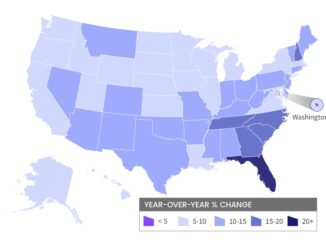

Inflation and the resulting increase in interest rates continued to dent home sales activity into the fall. The National Association of Realtors® (NAR) said on Friday that its Pending Home Sales Index (PHSI) which tracks […]