When the 30-year fixed rate dropped for the third straight week in late March, homebuyers responded, giving a boost to mortgage applications. And, following investors’ rush into bonds after the recent bank failures earlier this month, yields moved even lower last week — and mortgage rates followed.

Mortgage applications increased 2.9% week over week on a seasonally adjusted basis for the week ending March 24, according to the Mortgage Bankers Association (MBA). The refinance index increased by 5% from the previous week, and was 61% lower than a year ago.

In addition, purchase mortgage demand rose 2% from the previous week — a decline of 35% from 12 months ago.

“Application activity increased as mortgage rates declined for the third straight week. Home-price growth has slowed markedly in many parts of the country, which has helped to improve buyers’ purchasing power,” Joel Kan, MBA’s vice president and deputy chief economist, said. “Purchase applications remain over 30% behind last year’s pace, but recent increases, along with data from other sources showing an uptick in home sales, is a welcome development.”

But it’s not just mortgage demand that has fluctuated recently. New home sales also climbed in February for the third straight month, according to the U.S. Census Bureau and the Department of Housing and Urban Development (HUD).

February’s new home sales showed an uptick of 1.1% from January, climbing to a seasonally adjusted annual pace of 640,000 homes. However, new home sales were still down 19% on a year-over-year basis.

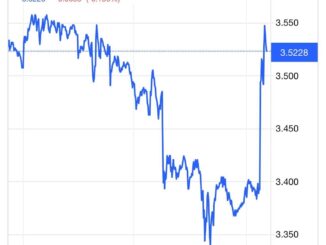

The 10-year U.S. Treasury yields declined from 4.08% on March 2 to 3.55% on March 28. The drop was driven by uncertainty over the banking sector’s health after the failures of Silvergate Bank, Silicon Valley Bank and Signature Bank were coupled with concern about the broader impact on the economy.

Historically correlated to 10-year treasury notes, the 30-year fixed rate with conforming loan balances ($726,200 or less) decreased to 6.45% last week, the lowest level in over a month, according to the MBA data. That’s down from 6.48% the previous week

Meanwhile, mortgage rates on jumbo loans (greater than $726,200) fell to 6.27% from 6.30% in the same period.

Is the spring buying season here?

While lower cost of capital will likely bring buyers back in a meaningful way, the latest market instability and the Federal Reserve’s federal funds rate hike will stress a lot of real estate agents, mortgage advisors and lenders to the core, said Daniel Arias, loan officer at We Fund LA, a division of New American Funding.

Arias said his pre-approval applications for March are in line with January’s numbers — but he hasn’t seen the busy spring buying season that everyone had hoped for.

“It (spring buying season) is not here, it’s not coming because of everything going on (…). I also think that the latest market instability and the latest hike in rates will stress test a lot of real estate agents, a lot of mortgage advisors, and a lot of mortgage companies to the core,” Arias said.

Arias said the spring season typically would have increased inventory levels that would indicate buyers and sellers are ready to come to the table.

“We only have an abundance of buyers right now. (…) I’m hoping spring and summer will kind of hopefully force some people to make their move, and if rates come down in June and July, sellers are going to be OK with coming to the market,” Arias said.