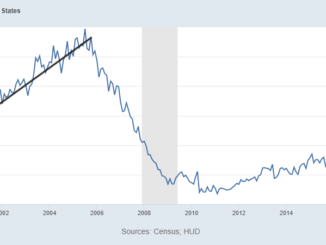

Applications for both home purchases and refinancing rose for the fourth time during the week ended March 24. The Mortgage Bankers Association (MBA) said its Market Composite Index, a measure of application volume, increased 2.9 percent on a seasonally adjusted basis and 3.0 percent unadjusted compared to the week ended March 17. The Refinance Index was 5 percent higher than the previous week and the refinance share of activity increased to 29.1 percent of total applications from 28.6 percent. The Index was 61 percent lower than the same week in 2022. [refiappschart] Purchase applications were 2.0 percent higher than the prior week on both an adjusted and an unadjusted basis but the unadjusted Purchase Index was 35 percent lower than the same week a year earlier. [purchaseappschart] “Application activity increased as mortgage rates declined for the third straight week. The 30-year fixed rate declined to 6.45 percent, the lowest level in over a month,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “While the 30-year fixed rate remained 1.65 percentage points higher than a year ago, homebuyers responded, leading to a fourth straight increase in purchase applications. Home price growth has slowed markedly in many parts of the country, which has helped to improve buyers’ purchasing power. Purchase applications remain over 30 percent behind last year’s pace , but recent increases, along with data from other sources showing an uptick in home sales, is a welcome development.”