The post Mortgage overpayments vs savings: what’s the best option for your cash? appeared first on Weekly Real Estate News.

Related Articles

Housing Wire

Mortgage payments fell in May while income rose

June 12, 2023

Mark Paul Cervantes

Housing Wire

Comments Off on Mortgage payments fell in May while income rose

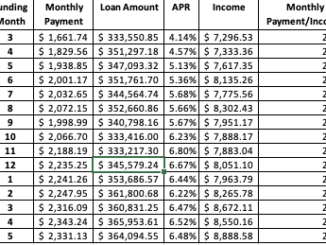

With mortgage rates still in the upper-mid 6% range, borrowers who received mortgages in May 2023 paid an average of $2,331 a month, up 20% from a year prior. That’s according to the latest origination […]

Mortage News

Mortgage Applications Decrease Again, Volatile Rates, Stagnant Inventories

May 25, 2023

Mark Paul Cervantes

Mortage News

Comments Off on Mortgage Applications Decrease Again, Volatile Rates, Stagnant Inventories

The Mortgage Bankers Association (MBA) said its Market Composite Index, a measure of mortgage loan application volume, decreased 4.6 percent on a seasonally adjusted basis during the week ended May 19 and was 5 percent […]

Weely Real Estate News

Mortgage refinance demand surged 6%, as rates dropped to the lowest level since September

December 24, 2022

Allen Santos

Weely Real Estate News

Comments Off on Mortgage refinance demand surged 6%, as rates dropped to the lowest level since September

Source: CNBC — Mortgage interest rates dropped again last week, and while that did little to bolster demand from homebuyers, it did send homeowners looking for savings on their monthly payments. Applications to refinance a […]