The post Goldman Sachs makes a bold housing market call appeared first on Weekly Real Estate News.

#GoldmanSachs

#HousingMarket

#RealEstate

#EconomicOutlook

#InvestmentBanking

#MarketAnalysis

The post Goldman Sachs makes a bold housing market call appeared first on Weekly Real Estate News.

#GoldmanSachs

#HousingMarket

#RealEstate

#EconomicOutlook

#InvestmentBanking

#MarketAnalysis

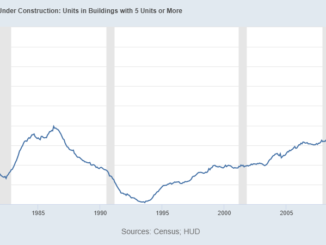

While the number of new homes rose by 4.2% in the U.S. last year, this was primarily led by a 22% increase in the multifamily sector. Single-family housing permits, meanwhile, slowed in 70% of […]

How is today’s housing starts data, which beat expectations, good for mortgage rates? Typically good economic data is bad for rates, especially in this environment, when a Fed member will come out and say building […]

Mortgage rates are now hovering around 7 percent — the highest they’ve been since 2007 — thanks to the Federal Reserve’s efforts to tame inflation. Central bankers have lifted their official policy rate to about […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes