The post 30-year fixed mortgage rates still ‘keeping some people away’ from buying a house: Realtor appeared first on Weekly Real Estate News.

The post 30-year fixed mortgage rates still ‘keeping some people away’ from buying a house: Realtor appeared first on Weekly Real Estate News.

Mortgage rates fell this week as the October inflation report drove down the yield on the 10-year Treasury. On Thursday, investors priced in a 99.7% chance that the Fed will hold interest rates steady in […]

Mortgage rates dropped to 6.78% this week, the biggest weekly decline since mid-March, as investors digested a raft of mixed incoming economic data. Freddie Mac’s Primary Mortgage Market Survey, which focuses on conventional and conforming […]

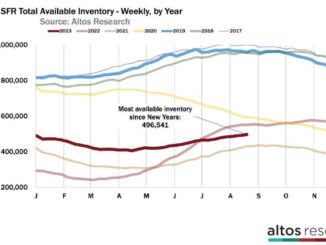

Mortgage rates only kept climbing in the last week. Buyers in this real estate market notice these affordability changes, and so we can see in the data fewer home purchase offers, slightly climbing unsold inventory, […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes