The post Why higher mortgage rates mark a return to normality appeared first on Weekly Real Estate News.

The post Why higher mortgage rates mark a return to normality appeared first on Weekly Real Estate News.

The dream of owning a home in America is slipping farther away for many, with average monthly mortgage payments now nearly double what they were at the start of the Biden administration. As interest rates […]

The shift from a refinance boom to a purchase market will leave some mortgage lenders and loan officers with only two options: “Consolidate or exit the business,” according to Mary Ann McGarry, Guild Mortgage’s chief […]

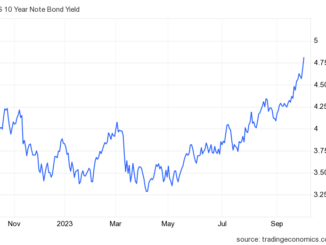

Mortgage rates and bond yields kept rising Tuesday as the job openings unexpectedly increased more than anticipated. But is that job openings data legit today? And will job openings continue higher, pushing mortgage rates even […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes