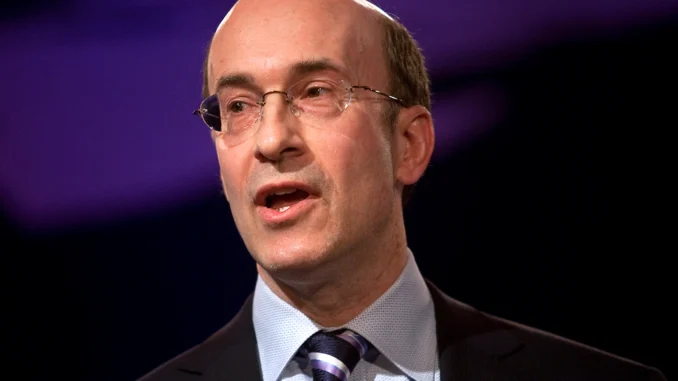

Pain across the US housing market that began last year is likely just getting started if interest rates remain high, star economist Ken Rogoff warned on Tuesday.

Rogoff, a professor at Harvard University and former top economist at the International Monetary Fund, said home prices in both the US market aboard will fall “certainly another 10%” over the “couple of years.”

The economist cited the restrictive policy stances taken by the Federal Reserve and other central banks, which have caused a spike in mortgage rates and cooled demand among buyers.

“If, as I think, interest rates are going to stay high for some time to come, I think there’s still a lot of downward adjustments in the housing markets globally, not just in the United States,” Rogoff told Bloomberg Television during an appearance at the World Economic Forum in Davos, Switzerland.

The Federal Reserve is expected to implement more interest rate hikes early this year after a string of seven straight supercharged interests in 2022. Fed Chair Jerome Powell has signaled that rates will rise and then hover in restrictive territory until policymakers have clear evidence that inflation has cooled.

Rogoff noted that the housing and stock markets each tend to struggle whenever central banks hike interest rates – though downticks in home prices tends to occur a longer period of time.

“Equities and housing move in sync with interest rates, but equities move much faster. Housing famously, prices, especially down, move much more slowly. People sit on their house, they don’t want to sell their house,” Rogoff said.

As The Post has reported, US housing activity slowed to a crawl last year as mortgage rates rose to their highest level in more than two decades.

Higher monthly mortgage payments caused cash-strapped buyers to think twice about buying homes and hurt sellers, who were forced to slash their listing prices to attract interest.

The average 30-year mortgage rate hovered at 6.33% as of last week, according to Freddie Mac. That marked an increase of nearly three percentage points compared to the same week one year earlier.

In November, Powell described conditions in the housing market as a “bubble” that was set to burst after prices reached “very unsustainable levels” during a pandemic-era housing boom.

Source: nypost.com