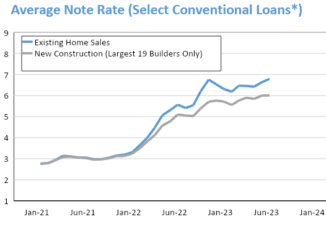

Rising mortgage rates & home prices reducing affordability, even as supply grows.

- Sales of new single‐family houses in April totaled a seasonally adjusted annual rate of 591,000, 16.6% below the revised March rate.

- The median sales price of new houses sold in April 2022 continued to climb, reaching $450,600, up 3.6% from a month earlier and 19.7% from April 2021.

- The 9-month supply of homes for sale represents the highest level since 2010.

As rising rates and prices curb the affordability of housing, new-home sales continued to decline in April, falling nearly 17% from a month earlier.

According to data released jointly today by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, sales of new single‐family houses in April totaled a seasonally adjusted annual rate of 591,000, 16.6% below the revised March rate of 709,000 and 26.9% below the estimate of 809,000 a year earlier.

Sales declined from March in all four U.S. regions. According to the report, sales fell 19.8% in the South, 15.1% in the Midwest, 13.8% in the West and 5.9% in the Northeast. Year-over-year sales also fell in all four regions. They were down 36.6% in the South, 25.5% in the Midwest, 17.1% in the Northeast and 12.4% in the West.

Odeta Kushi, deputy chief economist for First American Financial Corp., said the rate of sales in April fell well below the consensus expectations of analysts. “The consensus was 750,000, while actual was 591,000,” she said.

While sales fell, the median sales price of new houses sold in April 2022 continued to climb, reaching $450,600, up 3.6% from a month earlier and 19.7% from April 2021. The median price means half of the houses sold were sold for more and half were sold for less.

The average sales price, meanwhile, was $570,300, up 9.2% from March and 31.2% from a year earlier.

“New-home prices show their ‘downside stickiness,’” Kushi said. “Prices climbed nearly 20% on a year-over-year basis and reached a record high, despite the decline in sales.”

As a result, she said, “Affordability is a growing challenge, as higher new-home prices & rising mortgage rates are pricing out some buyers. One year ago, 25% of new-home sales were priced below $300,000. In April of this year, only 10% of new home sales were priced below $300,000.”

The seasonally adjusted estimate of new houses for sale at the end of April was 444,000, the report states. This represents a nine months’ supply at the current sales rate, a 30% increase from a month earlier and nearly double the 4.7-months supply a year earlier.

Kushi said the supply represents the highest level since 2010, and as a result, “Builders will likely slow construction in the months ahead.”

She continued: “By stage of construction, the share of completed homes sold was 27.7%, up from 26.2% one year ago, but still low compared to pre-pandemic levels. The share of homes under construction sold declined significantly.”

The share of completed homes/ready-to-occupy inventory in April, meanwhile, was 8.6%, down from 10.4% a year ago, while the share of new-home inventory that is under construction increased from 62.8% to 64.9%.

“The new-home market is sensitive to rising rates,” Kushi said. “While builders are facing some relief with material costs, buyers are faced with much higher borrowing costs. This is pricing out many new-home buyers, which will continue to have a slowing effect on the new-home market.”

Source: Nationalmortgageprofessional.com