So not only do we have a very limited number of homes underwater, but homeowners also have a lot of selling equity. The reason this is so important is that when we get another job loss recession, many households in America will have a cushion to sell their homes and not go into foreclosure at all. The second positive factor is that homeowners who haven’t lost their jobs can sell their homes and use that equity for a down payment for another house or even pay cash for the next purchase.

Days on market

One of the problems with having so many foreclosures and a lack of demand back in 2011 is that it took over 100 days to close a transaction — this is a sign of an unhealthy housing market. The National Association of Realtors tracks the days on market, and unlike 2011, when it took over three months, the most recent existing home sales report shows only 24 days on market this year.

In 2011, we had over 3 million active listings to start the year and today the NAR total active listings data is running at 1,128,000. Traditionally, I’d like to see the days on the market be between 30-45 days year-round. But since we have such low active listings today, even with 2024 being another year of low home sales, the days on the market are still under 30 days, which means homes that are priced right are selling quickly.

New listings

The most significant and glaring difference between 2011 and 2024 is the weekly new listings data for the peak season. It’s probably the second most enormous gap ever; only 2023 would be lower than this year.

Last week in 2011, 396,955 homes hit the market without a contract. For the same week this year, the number was 70,606 new listings. 2023 had the lowest new listings data and 2024 looks to be the second-lowest new listings data ever.

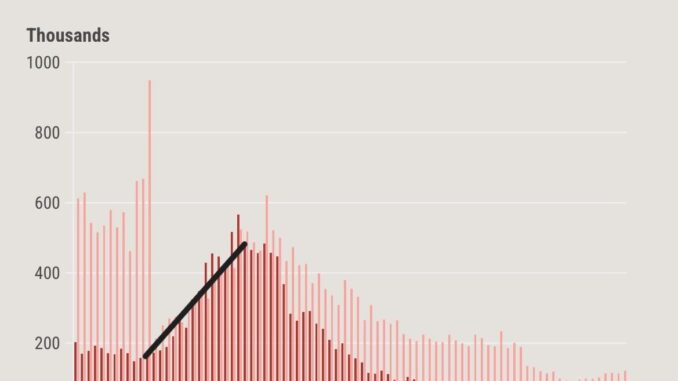

The background to this difference in new listings is important. We had a massive credit bust starting in 2005, which continued from 2006 to 2008 — all before the job loss recession began in 2008. As you can see in the chart below, credit broke years before the Great Recession, which is why we had so many new listings at that time. That is not the case now — I drew these black lines to make my point.

Of course, it wasn’t just 2011 that had a burst of new listings: from 2009-2012, the new listings data was running at 250,000 to 400,000 per week, whereas the last four years, we have been running at 30,000 to 90,000 per week, roughly.

New listings data for last week over the years:

2009: 281,734

2010: 345,146

2011: 396,955

2012: 318,041

What a difference a cycle makes!

Now, I could write about 16 different variables that make 2024 much different than 2011, but let’s keep it simple. This housing market is challenging in some ways, but we’re not headed for another 2008.

ENB

Sandstone Group