Despite the necessary requirement for a homeowner to maintain insurance on their property for protection against human- and naturally-occurring disasters, the impacts of climate change are creating “natural” scenarios that are increasingly not covered by insurance.

Such instances are accelerating in different parts of the country, leading insurers to drastically increase their prices, or, in some cases, pull out of areas they deem problematic.

As a result, the elevated rate of climate-related property risks is exposing a widening gap between insurance costs and coverage homeowners can rely on, according to a new report published by Deloitte.

The report illustrates a different kind of perfect storm: rising costs for insurers, and increasingly unaffordable premiums for customers colliding into a mess the marketplace has yet to fully account for. To get a better understanding of the implications, HousingWire interviewed report co-author Kelly Cusick, managing director at Deloitte Consulting.

The findings

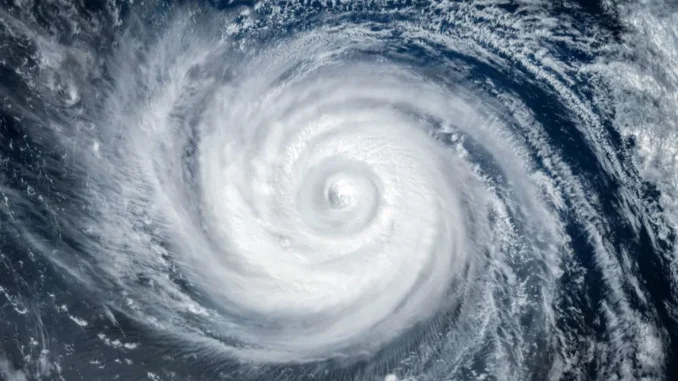

“Unusual natural events” stemming from climate change have become “an increasingly common reality for millions of homeowners in an era with more frequent — and more severe — weather events,” the report noted.

“Between 2019 and 2022, the number of severe climate-related disasters in the United States escalated by 32%, causing insured losses over the same period to rise by nearly 300%,” according to data sourced from the Insurance Information Institute last month.

Deloitte conducted a survey of 2,000 homeowners across 21 states in January, targeting “respondents who said their coverage is inadequate,” particularly in states at “high risk of climate-related disasters.” Researchers found that rising repair costs and more frequent claims are driving up the costs for insurers to provide coverage.

This has led some insurers — even larger ones — to pull back from areas they classify as “high-risk” altogether, making it more challenging for residents in those areas to find coverage, particularly adequate coverage at what they would consider a reasonable price.

“In California, for example, where many insurers have announced pullbacks due to increased wildfires, it has been estimated that there is a 20% reduction in insurance availability,” the report found.

As a result, 23% of respondents indicated they are struggling with shrinking insurance options, and over half of all respondents (53%) said their existing coverage options cost too much, leading them to either find more affordable (and less comprehensive coverage), or risk going without insurance altogether. One of the ways that the insurance industry might be able to tackle these challenges is by shifting toward a more collaborative model with public resources, Cusick said.

“There needs to be a shift towards collaborative solutions and proactive risk management,” she said. “The partnerships that insurance companies have with public entities and other industries, maybe focusing on those two things would help to address some of the challenges that exist today.”

Implications

Inadequate coverage hits lower-income households — defined for the purposes of the survey as $99,000 or less in annual household income — harder, potentially exposing them to greater risk of either economic hardship or exposure to elevated climate risks if they choose to forego maintaining coverage for economic reasons.

About 44% of respondents reported premium increases beyond the 11% national average in 2023, driving “widespread underinsurance concerns” and respondents feeling more exposed to natural disasters and climate events.

“In the Deloitte survey, several respondents said they were surprised by unexplained premium hikes despite minimal claims history,” the report reads. “Among respondents, only 29% had actually filed claims (to cover a loss), and about 50% of those who did were either denied or received approval for less than half of the damages filed due to coverage exclusions or insufficient limits.”

Survey respondents are also largely unsure about how to solve the outstanding issues of coverage comprehensiveness with the lack of affordability, Deloitte found. Sixty-three percent of respondents “expressed confusion about their policies,” according to the results, and 86% were “not taking advantage of state-sponsored insurance programs.”

Possible solutions

When asked about potential solutions, Cusick said that it often comes down to education.

“There are a lot of good things that exist already between what some of the states and some of the insurance companies are doing,” she said. “I think it’s really just trying to find ways that they can engage more meaningfully with their customers, because the statistics would imply that perhaps the communications that are happening — email, webinars, etc. — it’s just not hitting the mark enough.”

Partnerships could make a difference in that respect, finding different entities that might be able to more precisely tailor a message to homeowners. Increasing communications output under existing methods may also make a difference, Cusick said.

Insurers themselves may also find that their traditional methods for reining in costs — namely raising the prices of their premiums and restricting what coverage does — may not be sustainable considering the pace at which costs have risen across the board.

One way to address this could be through product innovation, Cusick explained, including the concept of “parametric insurance,” which “pays out a predetermined amount based on the size of an event as opposed to the size of the losses,” the report said.

“That takes away some of the uncertainty around whether a customer will get something,” she said. “That way, they have a little bit of cash in their hands when something happens just to get things going. And then, maybe [companies can] supplement that more with additional coverage later, but these are some solutions that are being explored.”