Inventory increases aren’t occurring at a super fast pace, but the number of homes on the market across the country keeps expanding.

As mortgage rates stay elevated and the number of unsold homes on the market grows — especially in the South — the leading indicators for future home sales prices continue to be softer than the current headlines suggest. These attention-grabbing headlines point out that home sales prices are 5%, 6% or even 7% higher than at this time last year.

But keep in mind that May 2023 was the weakest comparison point in sales pricing. At that point, the headlines were negative, but the leading indicators for prices were positive. This year is almost the opposite. The future price signals aren’t exactly negative, but they don’t indicate 7% price growth. Meanwhile, future home sales price gains over the next six to 12 months look flat at best at this point.

That can change if mortgage rates fall dramatically, but the current trends show weakening home prices, not strengthening.

The good news for the housing market is that the pace of sales is gradually improving due to the expanded supply. More homes are available to buy and, therefore, more homes are being bought. Elevated mortgage rates slow demand so that inventory grows, but in years past, the total sales volume has been restricted by the limited supply. That supply cap is gradually rising and sales volumes are slowly increasing too.

On May 16, Altos Research is hosting its monthly webinar, where we dive deep on all of the local data trends, as well as the leading indicators for what should happen the rest of 2024. In the video below, there’s a link to the webinar. Click that to reserve your spot now.

Altos Research tracks every home for sale in the country each week. The data so often defies expectations or changes very quickly. We track all the pricing, supply and demand, sales and all the changes in that data so you can understand immediately as it happens. Let’s dig further into the details of the U.S. housing market as we roll into May 2024.

Housing inventory

There are now just under 600,000 single-family homes on the market. That’s 33% more than last year at this time. The available supply of unsold homes is growing and will continue to grow — probably into August.

In a few weeks, we expect the market will have more homes available than at anytime in the past three years. By the end of the summer, it looks like inventory will finally be back above 2020 levels. But it’ll take several more years of elevated mortgage rates before inventory builds back to pre-pandemic levels of 2019 or earlier.

Inventory is up less than 1% for the week — not a big surge. Because the supply of unsold homes typically keeps growing until August, this illustrates how we’ll probably have 700,000 homes on the market before the typical seasonal decline takes hold in the fall.

In the video above, you can see in the inventory chart how this year’s trajectory is climbing and looks like it’ll cross the 2020 levels by July. Notice how inventory is climbing faster than last year, but two years ago when rates were jumping 100 basis points each month, inventory was climbing much more quickly.

There are now 83% more homes on the market than in May 2022. That comparison is shrinking: By July, it’ll be only 30% more than two years ago.

The takeaway for the inventory data is that the supply of unsold homes is climbing, but it’s not climbing super quickly. Two years ago, inventory was skyrocketing, but that’s not happening now. This is steady inventory growth that is closely associated with elevated mortgage rates.

New listings

There were 71,000 new, unsold listings of single-family homes across the country this week. That’s a small downtick from last week but still 21% more than a year ago. More home sellers are coming back to the market each week.

There were an additional 22,000 immediate sales this week. These are new listings that are already under contract, so they’re not counted in the active inventory. That makes a total seller count of 93,000 for the week, which is 20% more than last year at this time.

In 2022, however, there were 105,000 single-family homes listed for sale in the first week of May. At that time, there were more sellers and more sales. In fact 28,000 of these listings went into contract immediately, compared to 22,000 now.

Mortgage rates were on the rise, so there were sellers rushing to get their houses listed and there were buyers rushing to buy before rates went up further.

The takeaway from the weekly new listings data is that after two years of higher mortgage rates, sellers are slowly coming back into the market. We’ll continue to see the number of sellers grow gradually. But it should be pointed out that there’s no sign of a flood of sellers. We can see that more sellers are adding to inventory, and that’s keeping a lid on home prices, but there’s no signs in the data of a significant imbalance between sellers and buyers that might meaningfully drive down home prices.

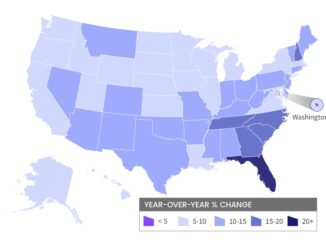

Around the country, sellers are growing in every market, but it is happening more frequently in some places. We’ve been sharing how Florida and Texas have driven much of this year’s inventory gains. In each of these states, housing costs (including insurance and taxes) are expensive and have climbed rapidly, so homeowners in these more expensive states are more likely to sell.

Pending sales

There are only 393,000 single-family homes under contract this week. The total number of pending home sales actually ticked down from a week ago, although it’s been climbing over the course of the spring as you’d expect. There are only 3% more homes in contract now than at this time last year. Many of the spring contracts were closed at the end of April, so there are slightly fewer this week.

There were 78,000 new contracts pending for single-family homes. That was up 1.5% for the week and 11% more than in the opening week of May 2023. Last year, this number was bouncing around 70,000 new pending contracts each week, but it’s closer to 80,000 this year.

This growth in new pending sales seems very encouraging. Sales still lag behind the pandemic-era boom years, and even 2022 — as previously mentioned — had more sales than we do now. But last year’s sales rate was so slow that nothing was working. This growth in sales is reflective of the fact that there are more homes for sale. Buyers have more options and are slowly grabbing hold of them.

On average, homes spend 30 to 40 days in contract before the sale closes. We can see that growth is just starting to expand over the past year (i.e., 3% more pending sales than 12 months ago but still 15% to 20% less than two years ago). Even so, the pace of sales is consistently coming in above last year’s. And it seems that many of these are all-cash transactions.

So, purchase mortgage volume may still be bouncing along its low points and not showing much growth yet, even as total sales are inching up. This count of pending sales, by the way, usually peaks in June, so cross your fingers for some strong sales growth over the next few weeks.

Home prices

The median price of these homes under contract is $399,999. Prices tend to cluster around the big, round numbers — in this case, $400,000. Home prices have been hovering just below $400K for five weeks now. At some point in the next few weeks, you can expect that prices will break through that barrier and lurch upward a bit before peaking in June.

The median list price is clustering just below $450,000 at $449,990 — up a tiny fraction from last week. Let’s explain what’s happening here. If you walk into the market today and want to buy a house, the median price of everything available is $450,000.

The peak price point for demand is lower than the median price of the available homes, so the homes under contract are going for roughly $400K.

In the video, there is a chart that highlights how slowly the active market is moving right now. The past three years of home price trends have been illustrated. In 2022 (the light red line on the chart), spring price trends were rising very quickly, even though inventory also building at that time. There were lots of sellers trying to get their deal done before rates rose too far. But if you didn’t have your house listed by May, you missed the window, and prices began to decline after that.

Contrast that with this year, where consistently higher mortgage rates have kept a lid on demand, so the active market has barely had any price movement all spring. The dark red line (2024) has a much more shallow slope than the previous years. You can use this as a leading indicator of future sales prices. If all the gains happen in the first half of the year, the year as a whole is setting up for very little in the way of price gains.

Price reductions

We’ll close today with price reductions. Slightly more than one in three homes on the market (33.5%) have included a cut from the original list price. That’s up 80 basis points from a week ago, which is a pretty notable jump for one week. Price cuts are definitely on the rise.

So, while the headlines are true when they report that home prices are up 5% to 7% from last year, the leading indicators for future home sales prices are slowing.

There are price cuts in every market — even in the hottest markets. As a rule of thumb, about one-third of homes on the market take a cut before they sell. Usually, there are fewer cuts in the spring and more cuts in the fall, and you can see in the video how each year clusters around 30%. This year, we’re already at 33.5% and rising.

If we stay on this pace, 40% of homes will have price cuts by July. That’s pretty bearish for future home sales prices. It shows that for today’s home sellers, there are fewer buyers than expected. Price cuts are climbing very clearly above (and more quickly than) most recent years.

Price cuts for the rest of the year will definitely be correlated with moves in the mortgage rates. And right now, rates have generally been moving up, causing demand to slow. That could change, but it hasn’t yet.