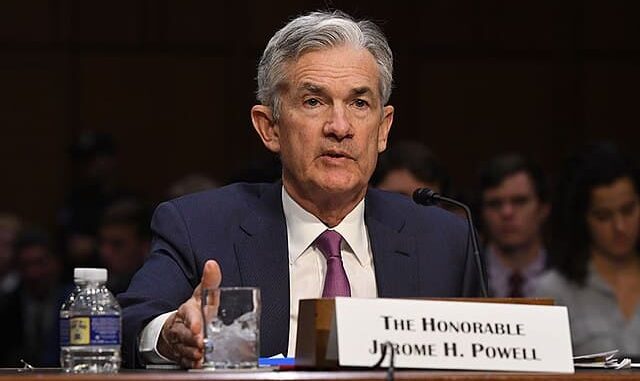

Federal Reserve Chairman Jerome Powell is no longer hinting that multiple rate cuts are likely later this year.

According to combined media reports, Powell used a question-and-answer session during a forum in Washington, D.C., yesterday on U.S.-Canada economic relations to glumly report that the latest inflation data is not showing the level of progress that would spur rate cuts.

“More recent data shows solid growth and continued strength in the labor market, but also a lack of further progress so far this year on returning to our 2% inflation goal,” he said, adding that the latest data “have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence.”

Although Powell insisted the central bank was not considering new rate hikes, he insisted rates would remain at their current 23-year high “as long as needed” if inflation fails to abate. The benchmark interest rate has been in a target range between 5.25%-5.5% since last July, a level achieved following 11 consecutive rate hikes beginning in March 2022.

“We think policy is well positioned to handle the risks that we face,” he continued. “Right now, given the strength of the labor market and progress on inflation so far, it’s appropriate to allow restrictive policy further time to work.”

Powell’s comments were echoed in a separate speech yesterday by Federal Reserve Vice Chairman Philip N. Jefferson, who stated, “While we have seen considerable progress in lowering inflation, the job of sustainably restoring 2% inflation is not yet done.”