Single‐family housing starts in March were at a rate of 1.02 million, according to new data from the U.S. Census Bureau and Department of Housing and Urban Development. This is 12.4% below the revised February figure of 1.16 million.

Privately‐owned housing starts in March were at a seasonally adjusted annual rate of 1.32 million, down 14.7% from the revised February estimate of 1.54 million and is 4.3% below the March 2023 rate of 1.38 million.

Single‐family authorizations in March were at a rate of 973,000, down 5.7% from the revised February figure of 1.03 million. Privately‐owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1.45 million, which is 4.3% below the revised February rate of 1.52 million but is also 1.5% percent above the March 2023 rate of 1.43 million.

Single‐family housing completions in March were at a rate of 947,000, a 10.5% drop from the revised February rate of 1.05 million. Privately‐owned housing completions in March were at a seasonally adjusted annual rate of 1.46 million, a 13.5% tumble from the revised February estimate of 1.69 million and 3.9% below the March 2023 rate of 1.52 million.

Reaction to the data was mixed to negative. First American Deputy Chief Economist Odeta Kushi, stated the March data “signals a loss of momentum for single-family construction, but perspective is important – single-family groundbreaking is still up 21% compared with a year ago and is more than 20% above the five-year pre-pandemic average.”

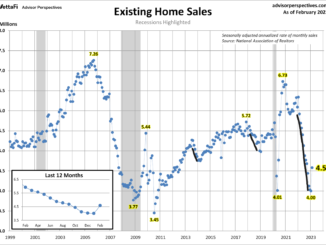

Kushi added that “the new-home market will likely continue to outperform the existing-home market over the near term because, unlike existing homeowners, builders are not rate locked-in.”

Danushka Nanayakkara-Skillington, assistant vice president for forecasting and analysis at the National Association of Home Builders (NAHB), was less optimistic, stating, “Single-family starts were down in March as interest rates increased and multifamily production fell as builders faced tighter financing conditions. And with single-family permits also down in March, single-family production will likely decline again in April.”

And Dr. Anthony B. Sanders, chief economist at Artesia Economics, expressed greater concern.

“For context, this is the largest month-over-month drop in housing starts since the Covid lockdowns,” he wrote in his Confounded Interest blog, who pointed to what he perceived as a disconnect between the market and the builders. “Intriguingly, while starts and completions plunged in March, the BLS believes that construction jobs surged to a new record high. Finally, just what will homebuilders do now that expectations for 2024 rate-cuts have collapsed? … If they build them, will homebuyers come?”