Weekly housing inventory data — both active inventory and new listings — are prone to one-week moves that deviate from a trend, especially if people are going Easter egg hunting. So, the fact that active inventory and new listings data fell last week isn’t a big deal. Although I expect some of the weekly data to rebound next week as a result, growth in active and new listings is still trending slower than I thought would happen in 2024.

But, despite the weekly moves, the one bright spot for housing is that housing inventory is growing on a year-over-year basis. Also, spreads between the 10-year yield and the 30-year mortgage got better last week, which is a big plus for the future if this trend continues.

Weekly housing inventory data

Active inventory still needs to be faster for my taste. My model has active inventory growing at least 11,000-17,000 every week with higher rates. This model was based on rates over 7.25%, but even when mortgage rates headed toward 8% last year, we didn’t see that kind of growth in inventory. This week, inventory fell week to week, but that’s the Easter bunny’s fault.

Weekly inventory change (March 29-April 5): Inventory fell from 517,355 to 512,930

The same week last year (March 30-April 7): Inventory rose from 410,734 to 411,577

The all-time inventory bottom was in 2022 at 240,194

The inventory peak for 2023 was 569,898

For some context, active listings for this week in 2015 were 1,021,567

New listings data

While the number of new listings isn’t growing as fast as I thought it would this year, it’s still growing, which means we have more sellers looking to buy a home once they sell. This variable can change when we experience a recession or job loss. However, for now, this is a plus for the U.S. housing market, and we should ignore the decline last week.

Number of new listings last week, by year:

2024: 54,769

2023: 55,008

2022: 63,374

Price-cut percentage

In an average year, one-third of all homes take a price cut; this is standard housing activity. When mortgage rates go higher and demand falls, the price-cut percentage grows; when rates drop, and demand gets better, the percentage falls.

It’s also critical to consider the year-over-year data with this line. Last year, when mortgage rates were heading toward 8%, the year-over-year price-cut percentage was continuously declining, which makes sense when you consider 2022 was a very abnormal year with the most significant home sales crash ever. As inventory is growing and demand isn’t booming on the mortgage side of things, the price-cut percentage is increasing year over year.

It’s critical to keep track of this data line as it shows price growth cooling down. That’s always what the doctor ordered because we have had massive housing inflation post-COVID-19. Having accurate weekly data gives us a big advantage to see what’s coming next.

Here’s the price-cut percentage for last week over the last several years:

2024: 32%

2023: 29.9%

2022: 17.6%

10-year yield and mortgage rates

We had some good and bad news last week with mortgage rates.

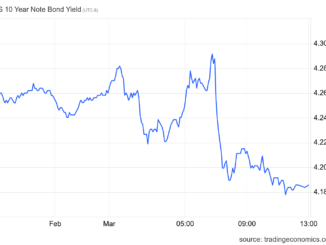

First, the bad news” The 10-year yield broke a critical support level on Friday, and if we get more bond market selling, that will pressure mortgage rates higher.

But the good news is that the spread between the 10-year yield and mortgage rates is getting much better, sooner than I thought it would this year. We didn’t see much reaction on Friday with mortgage rates because the spreads were good. This is a huge plus because if and when the 10-year yield falls and if the spreads get even better, this means we could quickly get sub-6% mortgage rates with the 10-year yield at 3.37% — without it even breaking my “Gandalf line in the sand.”

I wrote a detailed article on Friday analyzing the jobs report, and showing how the latest labor data gives the Federal Reserve a pathway to land the plane if they want. See here for more details and charts.

As you can see below, even though the growth rate of inflation has fallen a lot, CPI inflation has gone from over 9% year over year to 3.2%; the 10-year yield is still elevated. As always, the labor data is more important than inflation data for now.

Purchase application data

Purchase application data didn’t move much last week, making it back-to-back weeks with flat weekly data. It was flat on a week-to-week basis and down 13% year over year. Since November 2023, after making holiday adjustments, we have had 10 positive and six negative purchase application prints and two flat prints. Year to date, we have had four positive prints, six negative prints and two flat prints.

The data tells me that since late 2022, many people have been waiting for lower mortgage rates, and even though rates are elevated compared to the last decade, people still jumped back into the market. Imagine if mortgage rates stayed near 6% for a year — mortgage demand would grow and we wouldn’t need tax credits to boost demand for existing homes.

Week ahead: Inflation week!

We are jumping right from jobs week into inflation week with the upcoming CPI and PPI inflation data. These will be important reports as many market players have used the seasonal base pricing variable as a reason why the last two months’ inflation data was a bit hotter than usual. This week will be critical to watch because if the inflation data comes in cooler than anticipated, the 10-year yield should fall, and with spreads getting better, that will be a plus for mortgage rates.

ENB

Sandstone Group