Ahead of Friday’s national jobs report, mortgage rates have found stability after increasing for multiple weeks.

Polly’s average 30-year fixed rate for conventional loans was 7.17% on Tuesday, down from 7.24% one week earlier, according to HousingWire’s Mortgage Rates Center. At the same time one year ago, Polly’s 30-year fixed rate averaged 6.82%. Meanwhile, the 15-year fixed rate averaged 6.49% on Tuesday, down from 6.5% one week earlier.

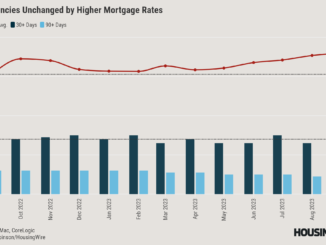

The Mortgage Bankers Association (MBA) has registered three straight weeks of purchase loan application declines as mortgage rates have risen. On average, it takes 30 to 90 days for higher mortgage rates to impact demand, according to HousingWire lead analyst Logan Mohtashami.

“For rates to come down, the labor data needs to get softer,” Mohtashami said.

The forthcoming jobs report from the U.S. Bureau of Labor Statistics will provide further clarity for mortgage rate trends.

“My primary data line for rates is jobless claims; if jobless claims rise faster, mortgage rates will go lower, regardless of what the Fed does,” Mohtashami said.

Meanwhile, inventory levels have shown year-over-year growth despite the prevailing high mortgage rates.

“Most home sellers are buyers of homes, so the action we are seeing this year is a healthy step in the right direction to get more balance in the housing market,” Mohtashami wrote on Saturday.

Between Feb. 23 and March 1, inventory rose from 497,608 to 498,339 (up 0.15%), according to Altos Research. Meanwhile, inventory rose year over year by nearly 19%. The most recent inventory bottom was in 2022 at 240,194 units, while the inventory peak in 2023 was 569,898. For context, active listings during the same time frame in 2015 were substantially higher at 958,304.

Investors’ focus will turn to Federal Reserve Chair Jerome Powell’s biannual monetary policy update scheduled for Thursday. Powell’s address is anticipated to be his final public statement before the Federal Open Market Committee’s next meeting on March 19-20.