The availability of mortgage credit increased in January, according to a report issued by the Mortgage Bankers Association (MBA) based on data sourced from ICE Mortgage Technology.

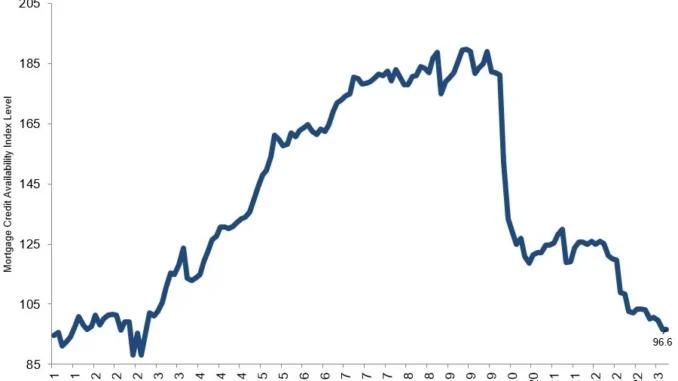

The MBA’s Mortgage Credit Availability Index (MCAI) increased in January to 92.7, or by 0.7% over December’s figure, based on initial benchmarking of the index to 100 in 2012. Rising figures indicate that credit standards are loosening, while tightened conditions are occurring when the MCAI trends downward.

The MCAI for conventional loans increased by 1.3% while the index for government loans stayed flat compared to December, the MBA explained in its data release. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.9% and the Conforming MCAI rose by 0.2%

The modest increase in mortgage credit availability stems from a greater number of conventional loan offerings, according to MBA senior vice president and deputy chief economist Joel Kan.

“However, overall credit availability remained close to 2012 lows, and the conventional index was close to its record low in the series dating back to 2011,” he said.

There are still other active headwinds to monitor despite the rise in these programs, however.

“Even though there was an increase in cash-out refinance programs available, credit supply overall is tight,” Kan explained. “The challenging lending environment has pushed many lenders to reduce costs by cutting back on certain aspects of their business, including exiting origination channels, which has contributed to lower credit supply.”