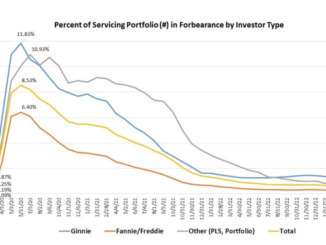

The Mortgage Bankers Association (MBA) reported the total number of loans now in forbearance decreased by 3 basis points to 0.23% as of Dec. 31.

According to MBA’s estimate, 115,000 homeowners are in forbearance plans. In December 2023, the share of Fannie Mae and Freddie Mac loans in forbearance declined 1 basis point to 0.15% while Ginnie Mae loans in forbearance decreased 8 basis points to 0.39%, The forbearance share for portfolio loans and private-label securities decreased 3 basis points to 0.27%.

“Forbearance as a loss mitigation option is diminishing,” said Marina Walsh, MBA’s vice president of industry analysis. “While forbearance is a powerful tool for delinquency surges resulting from natural disasters or major disruptions such as a pandemic, today’s borrowers are not experiencing widespread financial distress. The overall performance of servicing portfolios – particularly government loans – declined in December. Factors such as seasonality, a changing labor market, resumption of student loan payments, and the rise in balances on other forms of consumer debt are likely at play.”