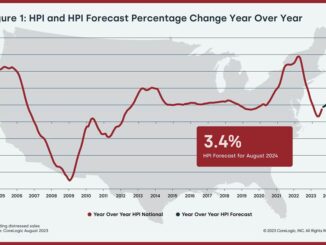

Today brings the release of the two main home price indices (HPIs) for the month of September (yeah, there’s a bit of a lag). The S&P Case Shiller HPI rose to prominence in the run up to the financial crisis (back then it was just Case Shiller), and has been a mainstay of home price tracking ever since. While there is a national version of the data, Case Shiller’s more popular HPI focuses on the 20 largest metro areas. The 20 city index is understandably more volatile (smaller sample size = more volatility), but some would say more indicative of what the average American is seeing. The Federal Housing Finance Agency (FHFA) oversees Fannie and Freddie, the enterprises that set conforming mortgage guidelines and guarantee a vast majority of mortgage debt. The FHFA also publishes the nation’s broadest HPI. It’s notably less volatile than Case Shiller, but both tend to be moving in the same direction at any given time. In the current release, for instance, Case Shiller reported a 0.2% increase in prices month-over-month whereas FHFA saw a 0.6% increase. Both numbers are 0.1% below last month’s revised reading. Year-over-year numbers help put the trends in perspective. In not so many words, prices are leveling off in moderately stronger territory after early 2023’s shift. That shift was “deceleration” according to FHFA and outright “contraction” according to Case Shiller’s several months spent in negative territory.