Sales fell below the $4 million mark in September, marking the slowest month for existing home sales since October 2010. The National Association of Realtors® (NAR) said sales of preowned single-family houses, townhouses, condos, and cooperative apartments sold at a seasonally adjusted annual rate of 3.96 million units last month, a 2.0 percent decline from the rate of 4.04 million posted in August. Home sales in September 2022 were at an annual rate of 4.68 million units. While the results were dismal, they were still slightly better than expected. Analysts for Econoday had a consensus estimate of 3.90 million units. Single-family home sales slipped to a seasonally adjusted annual rate of 3.53 million in September, down 1.9 percent from 3.6 million in August and 15.8 percent lower year-over-year. Condominium and co-op sales were recorded at a seasonally adjusted annual rate of 430,000 units in September, down 2.3 percent and 12.2 percent from the two earlier periods. “As has been the case throughout this year, limited inventory and low housing affordability continue to hamper home sales,” said NAR Chief Economist Lawrence Yun. “The Federal Reserve simply cannot keep raising interest rates in light of softening inflation and weakening job gains.” Sales may be falling, but home prices increased for the third consecutive month. September sales were at a median price of $394,300, an increase of 2.8 percent from the September 2022 median of $383,500. The median single-family home price was $399,200, an annual increase of 2.5 percent. Condo prices jumped 6.8 percent to a median of $353,800.

Related Articles

Loan Markets

US pending home sales rise for third straight month; loan demand increases

March 30, 2023

Mark Paul Cervantes

Loan Markets

Comments Off on US pending home sales rise for third straight month; loan demand increases

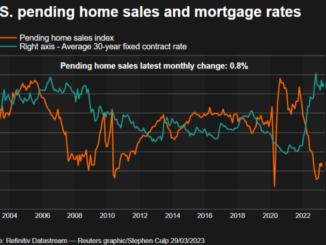

WASHINGTON, March 29 (Reuters) – Contracts to buy U.S. previously owned homes increased for a third straight month in February, raising cautious optimism that the housing market slump could be bottoming out. The National Association […]

Weely Real Estate News

Fannie Mae Forecasts Home Sales and Mortgage Origination Recovery in 2024

December 20, 2023

Allen Santos

Weely Real Estate News

Comments Off on Fannie Mae Forecasts Home Sales and Mortgage Origination Recovery in 2024

Single-family home sales likely bottomed out during the fourth quarter this year and are expected to begin a slow but meaningful recovery in 2024, according to the latest commentary from the Fannie Mae (OTCQB: FNMA) […]

New York Post

Home sales drop for first time since December as stiff mortgage rates sideline buyers

April 19, 2024

Mariel Alumit

New York Post

Comments Off on Home sales drop for first time since December as stiff mortgage rates sideline buyers

The spring homebuying season is off to a sluggish start as home shoppers contend with elevated mortgage rates and rising prices. Sales of previously occupied US homes fell 4.3% in March from the previous month to […]