U.S. home prices posted their biggest annual price increase since February 2023, reaching a 3.7% price gain in August, according to CoreLogic’s August 2023 Home Price Index. While home prices ticked up 0.3% month-over-month and forecasters expect continued growth over the next year, there are some housing markets likely to see price drops.

The median sales price for a U.S. single-family home did not budge in August, hovering at $375,000. It varied across states with California ($705,000), the District of Columbia ($630,000) and Massachusetts ($585,000) ranking as the top markets.

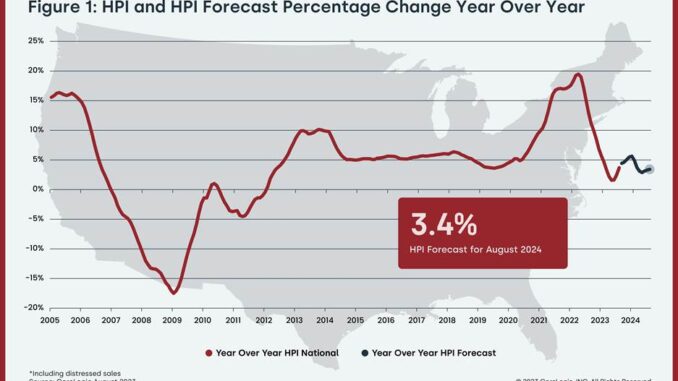

Year-over-year home prices have been rising continuously for 139 months, but the CoreLogic HPI Forecast points to a cooling of home price appreciation in 2024. It should ease to a 3.4% increase in August 2024 and a 0.2% increase in September 2023 according to the forecast.

“While continued mortgage rate increases challenge affordability across U.S. housing markets, home price growth is in line with typical seasonal averages, reflecting strong demand bolstered by a healthy labor market, strong wage growth and supporting demographic trends,” Selma Hepp, chief economist for CoreLogic, said in a statement. “Still, with a slower buying season ahead and the surging cost of homeownership, additional monthly price gains may taper off.”

Where prices are likely to fall

New Hampshire, Maine, Vermont and Rhode Island posted the largest yearly price increases in August. Meanwhile, eight states recorded home price decreases, most of them in the West: Idaho (-4%), Montana (-2.7%), Nevada (-2.3%), Utah (-2%), Washington (-1%), Arizona (-0.9%), Texas (-0.4%) and New York (-0.2%).

However, the report highlighted that “while some states in the West still posted annual home price losses in August, that number has been decreasing since the spring of this year.”

Miami continued to post the biggest home price growth in the country, at a 8.3% price increase in August. Forecasters at CoreLogic expect the declines in Southwest cities such as Las Vegas and Phoenix to reverse, with forecasted growth turning positive.

Meanwhile, the markets most at risk of price declines in the next 12 months were: Spokane-Spokane Valley, Washington; Cape Coral-Fort Myers, Florida; Youngstown-Warren-Boardman Ohio; Ocala, Florida; and Deltona-Daytona Beach-Ormond Beach, Florida, according to the CoreLogic Market Risk Indicator(MRI).