Mirroring the trend for new home sales(+4.4%), pending home sales rose 0.9% in July, according to data released Wednesday by the National Association of Realtors (NAR).

Year over year, pending home sales were down 14%, a smaller decrease than the 15.6% annual drop recorded in June. However, unlike the market for new homes, which has recovered convincingly above last year’s lows (+31.5%), pending home sales continue to lag behind year-ago levels (-14.0%). The NAR’s Pending Home Sales Index climbed to a reading of 77.6 in July. An index of 100 is equal to the level of contract activity in 2001.

“The small gain in contract signings shows the potential for further increases in light of the fact that many people have lost out on multiple home buying offers,” said NAR Chief Economist Lawrence Yun. “Jobs are being added and, thereby, enlarging the pool of prospective home buyers. However, rising mortgage rates and limited inventory have temporarily hindered the possibility of buying for many.”

Month over month, contract signings increased in the South and West but decreased in the Northeast and Midwest

Regionally, on a month-over-month basis, the South (95.3) and the West (61.3) pending home sales climbed and showed the smallest declines from one year ago, according to Realtor.com Chief Economist Danielle Hale. Meanwhile the Northeast (63.2) and the Midwest (77.5) interestingly fell, even though these two regions recently boasted more robust real estate activity and stronger pricing. Compared to a year ago, pending sales activity was down by more than 20% in the Northeast region, the biggest decline in that region over the past year, noted Lisa Sturtevant, Bright MLS chief economist.

“Greater availability of homes for sale in the South and price breaks in the West were likely contributors,” said Hale.

Overall, pending home sales fell in all four U.S. regions compared to one year ago.

Two consecutive months of increases doesn’t necessarily mean that the housing market is moving

The median existing home price crawled north of $400,000 in July while interest rates inched above 7%.

“These significant affordability challenges, as well as a continued dearth of inventory, lower the likelihood that pending sales will continue to grow,” said Kate Wood, home and mortgage expert at NerdWallet.

While it is common for pending sales to decline between June and July, this year’s situation is tougher, said Sturtevant.

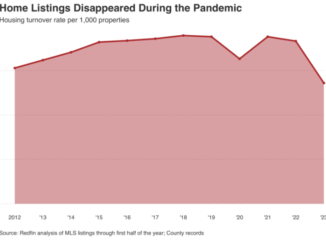

“Buyers are being forced to lengthen their home search since there are so few properties available for sale,” she said.

In fact, two out of three Mid-Atlantic buyers who purchased in July had to make an offer on more than one home before they were successful, found a Bright MLS’s recent survey.

Sales activity is expected to remain slow for the rest of the year, as inventory remains low and mortgage rates remain high, noted Sturtevant.