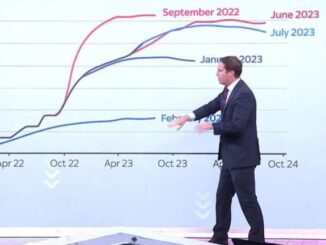

The volume of mortgage applications fell during the last week of June as compared to the prior week which had contained an adjustment to account for the Juneteenth holiday. The Mortgage Bankers Association (MBA) reported a decline of 4.4 percent in its seasonally adjusted Market Composite Index. The change ended a three-week streak of volume gains. On an unadjusted basis, however, that index did move 6.0 percent higher. The Refinance Index decreased 4 percent from the previous week and was 30 percent lower than the same week one year ago. The refinance share of applications ticked up to 27.4 percent from 27.2 percent. [refiappschart] The seasonally adjusted Purchase Index declined 5.0 percent but was 6.0 percent higher before adjustment. Applications were down 22 percent from the same week in 2022. [purchaseappschart] “Mortgage applications fell to their lowest level in a month last week as rates for most loan types increased. As mortgage-Treasury spreads remained wide, the 30-year fixed rate increased to 6.85 percent, the highest rate since the end of May,” according to Joel Kan, MBA’s Vice President and Deputy Chief Economist. “ Purchase applications decreased for the first time in a month, as homebuyers remained sensitive to rate changes. Rates are still over a percentage point higher than a year ago, and housing affordability is still a challenge in many parts of the country. However, the average loan size for a purchase application declined to $423,500 – its lowest level since January 2023. This was likely driven by reduced purchase activity in some high-price markets and more activity in some of the lower price tiers as buyers searched for more affordable options.”