Despite the slight increase in optimism, RCLCO’s latest survey points to an impending recession.

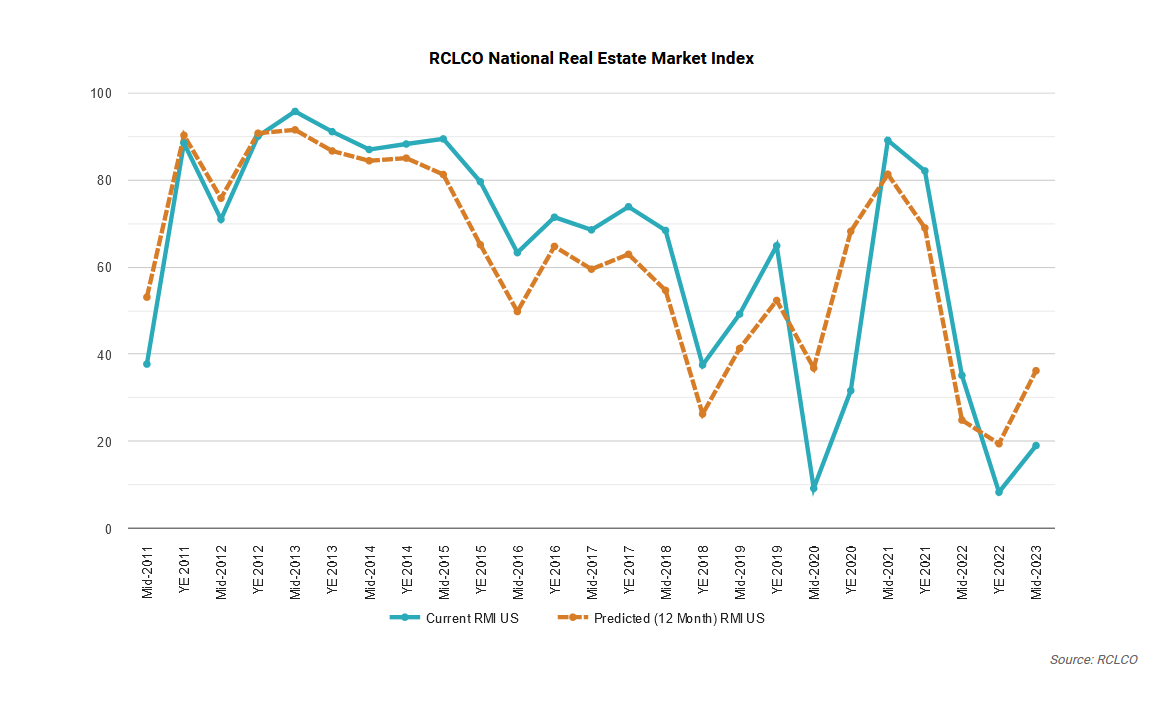

“Better, but still not good” is how RCLCO describes their mid-year National Real Estate Market Index (RMI), the product of the company’s latest Sentiment Survey.

In the past six months, the RMI has risen by 10.7 points, from a record-low 8.3 points at year-end 2022 to 19.0 now, yet the index remains in perilous territory. An RMI below 40 (on a scale of 0 to 100 points) “is typically consistent with a period of real estate market distress/recession,” RCLCO says.

Over the dozen years that the RMI has tracked real estate market conditions in the U.S., the past three years have been especially volatile, what with the pandemic, war in Ukraine and recent rate hikes by the Fed.

Loading…