While prices remained elevated, sales activity was enervated.

The post California’s Median Home Price Back Above $800K appeared first on Weekly Real Estate News.

While prices remained elevated, sales activity was enervated.

The post California’s Median Home Price Back Above $800K appeared first on Weekly Real Estate News.

Annual home price growth remained in double digits in September even as home sales and purchase mortgage volume continued their months’ long declines. The CoreLogic Home Price Index (HPI), the earliest look each month at […]

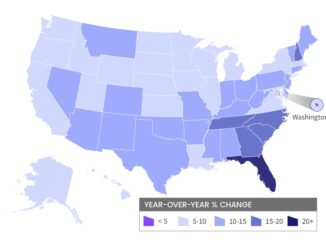

Home prices continued to cool at the start of the year, falling to a 3.8% annual price growth rate in January, according to the S&P CoreLogic Case-Shiller National Home Price Index, released Tuesday. The annual growth rate in […]

Even as home prices continued to post strong year-over-year growth in August, rising 13.5% for the 127th consecutive month of annual gains, CoreLogic is predicting much smaller yearly home price growth moving forward. August’s double-digit […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes