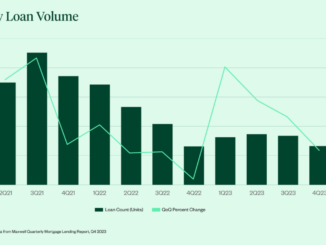

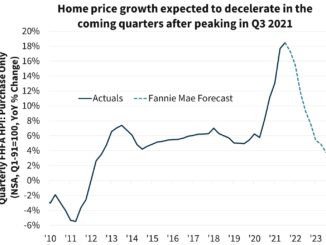

The Mortgage Bankers Association (MBA) noted a slight decrease in mortgage applications during the week ended April 28. Joel Kan, MBA’s Vice President and Deputy Chief Economist, said the 1.2 percent decrease in MBA’s seasonally adjusted Market Composite Index and the 0.4 percent dip in the index before adjustment came despite interest rates that moved lower for the first time in three weeks. “The 30-year fixed-rate decreased five basis points to 6.5 percent, which is still 114 basis points higher than a year ago,” Kan said. “Elevated rates continue to both impact homebuyer affordability and weaken demand for refinancing. Home purchase activity has been very sensitive to rates and local market trends, including the very low supply of existing-home inventory. However, newly constructed homes account for a growing share of inventory, giving more options for prospective buyers.” The Refinance Index rose 1 percent compared to the prior week but remained 51 percent below the level during the same week in 2022. The refinance share of mortgage activity continued to fall, representing 27.2 percent of total applications, down from 26.8 percent the previous week. [refiappschart] The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index lost 1 percent and was 32 percent lower than the same week in 2022. [purchaseappschart] Kan continued, “ The jumbo-conforming spread continues to narrow, an indication that there is reduced lender appetite for jumbo loans following the recent turmoil in the banking sector and heightened concerns about liquidity. The spread was 13 basis points last week, after being as wide as 64 basis points in November 2022.”