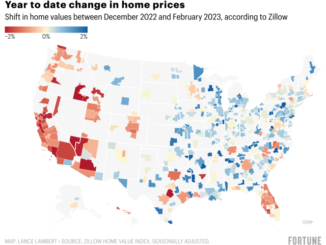

Today brings the latest monthly installment of the two major home price indices from Case Shiller and the FHFA. While these numbers only bring us up to February, they show more evidence of the same trend we pointed out last month when we asked: are home prices already done falling? If you were to ask the same question of today’s data, the answer is even clearer.

Even the more volatile Case Shiller 20 city index moved back into positive territory in month-over-month terms. The modest +0.1% increase is especially notable given that the median forecast called for a drop of 0.4%. FHFA’s index accelerated from 0.1% in Jan to 0.5% in Feb.

If there’s a “yeah but,” it would be that prices bounced in a similar way back in 2006, right before things got way worse: Fortunately, that “yeah but” can be dismantled fairly quickly with just about any chart that shows the current inventory situation.

Note the difference between then and now. Looking beyond inventory, the mortgage market is infinitely more sound these days. Back then, it wasn’t uncommon to see competitive rates on silly loans (borrow 100% of a homes value with no verification of income or assets… what could go wrong?).

Credit is much tighter now, and unlikely to loosen any time soon, and even less likely to ever return to the “lesson learned” levels that preceded the financial crisis. All this having been said, keep in mind our warning from last time: you will likely see year-over-year indices drift into negative territory owing to the all-time-high price peak in early 2022. This will happen first for Case Shiller’s 20-city index, likely with next month’s update. When it does, remember it will mostly be a reflection of how high prices were in 2022.