Mortgage rates are likely to remain elevated through the summer, after Federal Reserve policymakers held the benchmark interest rate steady at their latest meeting.

As expected, the Fed on Wednesday left the federal funds rate unchanged at a target range of 5.25% to 5.5%. The U.S. central bank has now held rates firm at that level for nearly a year, after rapidly raising them from near zero to combat soaring inflation.

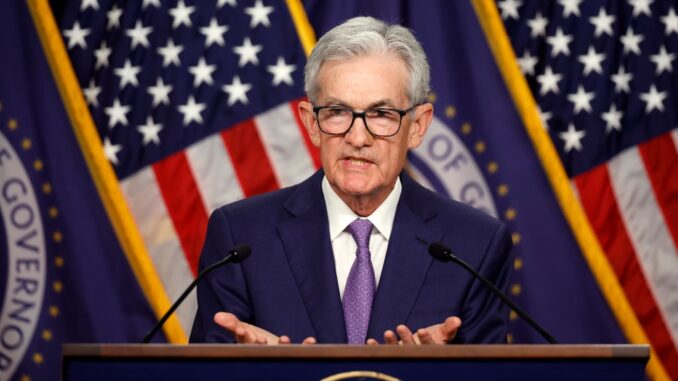

In remarks following the rate announcement, Fed Chair Jerome Powell said that inflation has “eased substantially” from its recent peak two years ago. But he conceded that inflation is “still too high” and remains above the Fed’s 2% target, after data earlier on Wednesday showed annual inflation at 3.3%.

Fed policymakers now expect to make just one rate cut by the end of this year, according to projections released by the central bank. Bond markets don’t view a cut as likely until the Fed’s September meeting at the earliest, when traders price in a 64% probability of lower rates, according to the CME FedWatch Tool.

“The fact that the Fed scaled back the number of rate cuts from three to one is going to disappoint those who were hoping for a summer rate drop,” says Bright MLS Chief Economist Lisa Sturtevant. “Mortgage rates, which have remained higher for longer, will likely remain in the high [sixes] until later this year. Some homebuyers who have been sidelined by affordability challenges are going to wait until rates come down to buy.”

Mortgage rates currently remain near two-decade highs, with the average rate on a 30-year fixed loan standing at 6.99% for the week ending June 6, according to Freddie Mac. Although mortgage rates aren’t tied directly to the federal funds rate, they are unlikely to decline significantly until a Fed rate cut seems imminent.

“For home shoppers and sellers, I expect that peak mortgage rates likely remain in the rearview, but volatility remains a risk, complicating moving decisions for home sellers, homebuyers, and renters alike,” says Realtor.com® Chief Economist Danielle Hale.

“While the median listing price on Realtor.com has risen 37.5% since May 2019, home prices on a per-square-foot basis are up 52.7%, or more than double the pace of overall inflation in that period,” adds Hale. “When combined with rising mortgage rates, affordability has been stretched and may be at a breaking point, especially for young households who do not own a home and cannot tap into the record-high level of home equity that existing homeowners can access.”

Inflation remained flat in May despite rising housing costs

The Fed’s latest decision on interest rates came hours after the latest U.S. inflation data, released by the Department of Labor earlier on Wednesday.

In a welcome surprise, the consumer price index remained flat in May from the prior month. The index rose 3.3% from a year ago, a slowdown from the 3.4% annual rate recorded in April.

Grocery prices were flat from April to May, while gasoline prices dropped 3.6% on the month, helping to keep overall inflation in check, the report showed. But more than offsetting falling gas prices were rising shelter costs, which rose 0.4% on the month and 5.4% on an annual basis.

Shelter accounts for more than a third of the CPI and is largely dictated by trends in the rental market. Although most Americans are homeowners, the CPI calculates their housing costs through “owner’s equivalent rent,” which roughly speaking is what a homeowner would expect to pay each month if they were renting their primary residence.

Owner’s equivalent rent of a primary residence accounts for 25% of the CPI. The category rose 0.4% from April to May, and 5.6% from a year ago.

However, the Labor Department’s method for calculating shelter costs for homeowners has faced criticism, including claims that it lags changes in the rental market by about a year, and doesn’t accurately reflect the actual monthly costs faced by homeowners.

The recent Realtor.com rent report for May showed median apartment rents declined on an annual basis for the 10th month in a row.

“The non-official private sector data points to rising apartment vacancy rates from temporary oversupply, and rents are essentially showing no increases. So, official consumer price inflation, with a lag time, no doubt has more room to slow down,” said National Association of Realtors® Chief Economist Lawrence Yun in a statement.

Speaking to reporters on Wednesday, Powell acknowledged the lag time in reporting changes to shelter costs and defended owner’s equivalent rent as a metric for reporting housing costs.

“It’s one of the very hardest things in inflation and prices is how to think about the services that someone is getting by living in a home that they could rent, but they’re actually living in” and own, said Powell. “Some countries just ignore that, but that’s not how we do inflation here.”

Fed faces growing calls to cut rates

Powell’s defense of how the U.S. measures housing inflation came after a pointed critique from a former White House adviser, who argues that the Fed’s restrictive monetary policy is exacerbating issues in the housing market based on a faulty measurement of shelter inflation.

Jim Parrott, a former senior economic adviser in the Obama administration, made the case in a Washington Post op-ed last week, co-authored with Moody’s Analytics Chief Economist Mark Zandi.

“The Fed’s aggressive rate hikes have helped cool inflation, but its insistence on keeping rates higher for longer is based on a serious misjudgment of the role the cost of owning a home plays in inflation and threatens to do unnecessary harm to the economy,” the duo wrote.

Parrott and Zandi argued that owner’s equivalent rent is a “flawed” measure of inflation “relying heavily on an ill-conceived notion of the cost of homeownership.”

That’s because most Americans either own their home outright or have a fixed-rate mortgage that they took out years ago before interest rates rose, meaning that their monthly cost of homeownership has not risen, they wrote. Yet according to federal inflation metrics, their shelter costs have risen in tandem with those of renters.

“If the Fed followed the sensible lead of the rest of the developed world and removed this variable from its measures, it would find that inflation is right on its target at 2 percent. Indeed, it has been there since last fall,” they wrote.

Worse still, high interest rates are responsible for the current surge in actual home prices, because they make it harder to finance sorely needed construction of millions of new homes, the duo argued. Higher mortgage rates have also depleted the number of existing homes for sale, due to the “lock-in” effect for homeowners.

In essence, Parrott and Zandi argued that the Fed is fighting phantom inflation based on a flawed assessment of housing costs, while simultaneously fueling real inflation in home prices.

“It’s time for the Federal Reserve to declare victory in its war on inflation and cut interest rates,” they wrote.

Real Estate – Latest NYC, US & Celebrity News | New York Post