Sen. Elizabeth Warren (D-MA) is demanding the Federal Reserve cut the federal funds rate during its policy meeting this week.

Warren, joined by Sens. Jacky Rosen (D-NV) and John Hickenlooper (D-CO), wrote a letter to Federal Reserve Chairman Jerome Powell stating a rate cut will address inflation concerns while reversing further economic challenges.

“The Fed’s current interest rate policy is also having the opposite of its intended effect: it is driving up housing and auto insurance costs, which are currently the main drivers of the overall inflation rate,” the senators wrote, noting that “housing-related inflation is directly driven by high interest rates: reducing rates will reduce the costs of renting, buying, and building housing, lowering Americans’ single highest monthly expense. Lowering interest rates will likely also decrease the cost of auto insurance as well, which has risen due to factors completely unrelated to the cost of lending.”

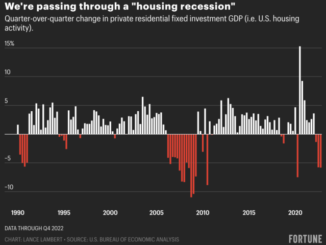

Furthermore, the senators noted the impact of high interest rates on construction costs.

“The country is already facing a severe housing shortage, and the Fed’s refusal to bring down interest rates is exacerbating this shortage and driving higher inflation rates,” the senators added.

The senators noted last week’s rate cuts by the Bank of Canada and the European Central Bank, along with cuts by the central banks of several European countries. They also called attention to comments by Moody’s Analytics Chief Economist Mark Zandi, who decried high rates “are like a corrosive on the economy; you know, they wear the economy down, and at some point, something could break.”

The Fed will announce its decision of rate levels on June 12 at 2:00 p.m. EDT.