Florida’s Miami-Dade County finds itself in the throes of a staggering affordable housing deficit, with more than 90,000 units needed to accommodate residents, according to a report from Miami Homes For All.

According to the nonprofit organization’s findings, the county is grappling with a shortfall of 90,181 units tailored for households earning less than 80% of the area median income, which equates to approximately $75,000 annually.

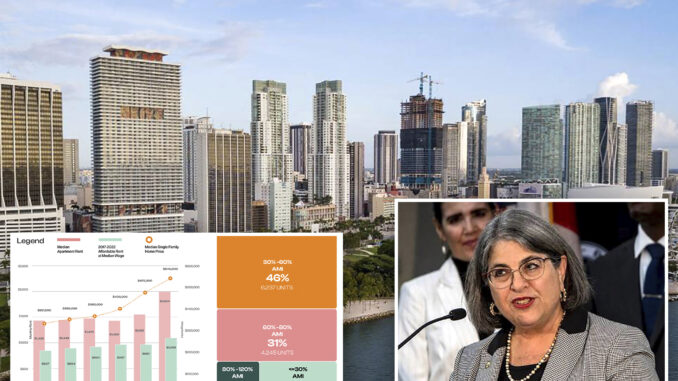

This revelation, disclosed during a recent affordable housing presentation at the Beacon Council’s Brickell headquarters and reported by The Real Deal, shows the severity of what Annie Lord, Executive Director of Miami Homes For All, has termed the “largest affordability crisis” in the nation.

Despite efforts to alleviate the crisis, manifested in approximately 14,000 units across 101 projects in the pipeline, financial hurdles remain a significant barrier.

Of these forthcoming units, 6,237 are earmarked for households earning between 30 and 60% of the area median income, while 4,245 units are designated for those earning between 60 and 80%.

Moreover, 1,156 units are allocated for households earning between 80 and 120% of the area median income, with an additional 2,053 units targeted for those earning less than 30%.

However, the realization of these projects hinges upon substantial financial investment, necessitating approximately $1.5 billion in funding, as noted by Marvin Wilmoth, managing principal of Intersection Ventures, during the presentation. Wilmoth further emphasized that this initial investment could unlock an additional $3.3 billion in subsidies and other forms of funding.

Miami-Dade County Mayor Daniella Levine Cava lamented the persistent unaffordability plaguing the region, noting that rents remain prohibitively high, driving the workforce away.

Housing prices continue their ascent, with median single-family home prices surging 14% year-over-year to $650,000, while median condo prices escalated by 11% to $445,000.

In response to the crisis, Levine Cava had proposed a $2.5 billion general obligation bond to fund affordable housing initiatives, but encountered opposition, prompting a postponement. She now advocates for an even larger bond to address the need.

Despite recent strides, including county funding secured for 68 multifamily developments comprising 8,700 units this quarter, Levine Cava stressed not solely relying on federal or local funding to address the housing shortage.

Meanwhile, Florida’s Live Local Act, designed to incentivize developers to incorporate workforce housing into their projects, has not been a focus of recent discussions. Signed into law last year, the legislation offers tax and zoning incentives but primarily benefits renters earning up to 120% of the area median income.

Looking ahead, Levine Cava emphasized the urgency of a comprehensive approach, urging construction companies and developers to prioritize the community’s needs to avert further economic destabilization.

As the region grapples with a mere 1.4% unemployment rate, she warned that failing to address the housing crisis could jeopardize the very workforce essential for sustaining Miami-Dade’s economic vitality.

“We have to get our construction companies and our developers to think realistically about the needs of this community because it’s at our own peril,” Levine Cava said. “If we drive out the workforce, which we already are doing, we’re at 1.4% unemployment, that is not a good sign. That is not healthy, and it means that we do not have the workers that we need to support our economy.”

Real Estate – Latest NYC, US & Celebrity News