Friday’s jobs report came in as a miss of estimates and wage growth came in lower than expected. The labor market isn’t tight anymore and that will eventually be good news for mortgage rates.

After last month’s jobs report, I talked about the path the Federal Reserve could take to land the plane based on wage growth data slowing down and getting closer to the Fed’s model. Today’s wage growth data continued that trend as we now have a three-handle on the 12-month hourly wage growth data. The Fed’s fear that wages would spiral out of control was always silly: on a three-month average, wage growth is at 2.8%.

So where does this leave us? Let’s look at my labor economic model that started on April 7, 2020, and see where are we today.

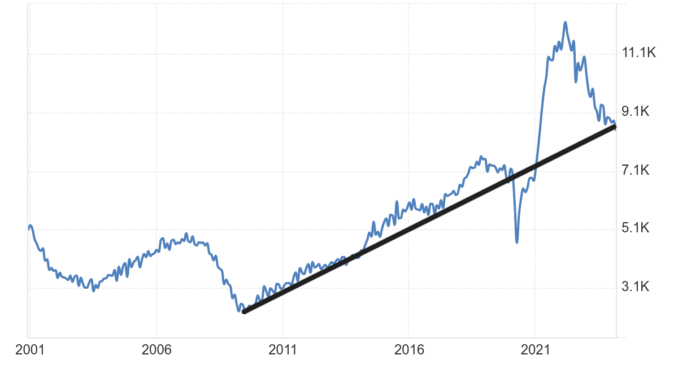

1. The current state of the labor market results from a series of events, with COVID-19 being a significant catalyst. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

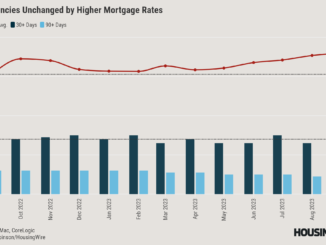

2. During the early stages of the labor market recovery, when we observed weaker job reports, I remained steadfast in my belief that job openings would reach 10 million in this recovery. Despite the unexpected job report in May 2021, I was confident in the recovery trajectory. Job openings reached as high as 12 million and are now at 8.5 million. Today the labor market is less tight, but the Fed would love to see this number even lower, down to 7 million.

Currently, the job opening quit percentage and hires data are below pre-COVID-19 levels. We are getting closer to having a single handle on this data, which, when coming from an elevated level, means any Fed member talking about a tight labor market is smoking some good stuff.

3. I wrote that we should get back all the jobs lost to COVID-19 by September 2022. This would be a speedy labor market recovery but it happened right on schedule.

4. This is the key one right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, based on the job growth rate in February 2020. Today, we are at 158,286,000. This is vital because given this level, job growth should be cooling down now. We will be more in line with where the labor market should be when the average is 140,000 to 165,000monthly.

Today’s job print of 175,000 is still above my target level for where jobs should be and we are getting closer to that 159 million total nonfarm payroll number. I will be shocked if we are still trending above 165,000 per month once we break over 159 million total employed people. With that said, the labor market is still outperforming my model.

Looking at the six-month average of job-growth data, we are running at 242,000, even with all the revisions. I am still above my 165,000-per-month level, but we are heading in that direction.

From BLS: Total nonfarm payroll employment increased by 175,000 in April, and the unemployment rate changed little at 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

Less than a high school diploma: 6.0%

High school graduate and no college: 4.0%

Some college or associate degree: 3.3%

Bachelor’s degree or higher: 2.2%

A critical part of this report is that wage growth is cooling down, which is key to many of the Federal Reserve’s concerns. The Fed likes a 3% wage growth trend because they believe productivity is 1%. As you can see below, wage growth is continuing to head in that direction.

We now have multiple data lines that show the labor market isn’t as tight as it once was. The Federal Reserve is now considering this since they have been talking more about their dual mandate as opposed to just being a single mandate Fed. This is positive for mortgage rates because once they pivot, we can see a more sustained move lower in rates instead of what we have had to deal with since 2022. We still have some work to get wage growth back down to a 3%-3.5% level, but it’s at least heading that way.