Home prices rose to a new record in February amid an ongoing housing shortage, even as high mortgage rates pushed affordability out of reach for more Americans.

Prices increased 6.4% nationally in February when compared with the previous year, the S&P CoreLogic Case-Shiller index showed on Tuesday. That is up from the 6% annual increase recorded the prior month. It marks the fastest pace of growth since November 2022.

On a monthly basis, prices climbed 0.4%, according to the index.

“Home prices continue to defy expectations in the face of high mortgage rates and worsening affordability,” said Lisa Sturtevant, Bright MLS chief economist.

The 10-city composite, which encompasses Los Angeles, Miami and New York, rose 8% annually, compared with an increase of 7.4% in January. The 20-city composite, which also tracks housing prices in Dallas and Seattle, posted an annual gain of 7.3%, which also marks an increase from the 6.6% figure recorded the previous month.

Prices rose in 18 of the 20 major metro markets tracked by the index.

The largest price gain took place in San Diego, which recorded a year-over-year increase of 11.4%. It was followed by Chicago and Detroit, each with an 8.9% increase. In fact, home prices in San Diego, Los Angeles, Washington, DC, and New York all hit an all-time high in February.

Portland, Oregon, saw the smallest gain in February, with home prices climbing just 2.2% from the prior year.

“Following last year’s decline, US home prices are at or near all-time highs,” said Brian Luke, head of commodities, real and digital assets at S&P DJI, in a release. “Since the previous peak in prices in 2022, this marks the second time home prices have pushed higher in the face of economic uncertainty.”

The Case-Shiller index reports with a two-month delay, meaning it may not capture the latest ongoings in the market.

There are a number of driving forces behind the affordability crisis. Years of underbuilding fueled a shortage of homes in the country, a problem that was later exacerbated by the rapid rise in mortgage rates and expensive construction materials.

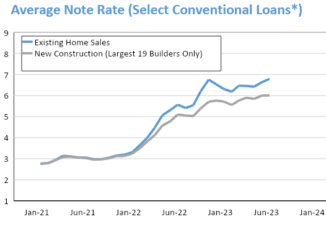

Higher mortgage rates over the past three years have also created a “golden handcuff” effect in the housing market. Sellers who locked in a record-low mortgage rate of 3% or less during the pandemic began have been reluctant to sell, limiting supply further and leaving few options for eager would-be buyers.

Economists predict that mortgage rates will remain elevated in 2024 and that they will only begin to fall once the Federal Reserve starts cutting rates.

Even then, rates are unlikely to return to the lows seen during the pandemic. On top of that, investors are growing skeptical about the odds of a Fed rate hike this year given the string of hotter-than-expected inflation reports at the beginning of the year.

Real Estate – Latest NYC, US & Celebrity News | New York Post