In most presidential election years, home prices aren’t a key issue for voters or a major campaign talking point.

Consider it another way in which the 2024 election is anything but typical. With mortgage rates up and home prices out of reach for many first-time buyers, the affordability crisis is increasingly in the spotlight as campaign season heats up.

In March, President Biden delivered a speech on home prices in the key swing state of Nevada after proposing a $10,000 tax credit for first-time buyers and those selling their starter homes.

Donald Trump fired back in a campaign video, accusing Biden of “waging full-scale war on the suburbs” that would decimate home values by expanding affordable housing options.

In addition to Nevada, the election will come down to just six other swing states: Arizona, Georgia, Michigan, North Carolina, Pennsylvania, and Wisconsin. Trump won all of them but Nevada in 2016, while Biden carried all but North Carolina in 2020. Neither candidate can win this year’s election without taking at least three of the swing states, unless the electoral map changes dramatically before November.

The debate comes as housing affordability reaches some of the most abysmal levels on record. Nationally, median list prices are up 28% since January 2021, and the home price-to-income ratio is at a record high of nearly 6-to-1, up from a ratio of 4.1-to-1 as recently as 2019.

The cost burden for renters is also alarmingly high, with nearly half of all renters in the nation spending more than 30% of their income and a quarter spending more than 50% on rent each month, according to U.S. Census data. Those sky-high rental burdens can make it difficult to impossible for many renters to save up for a down payment on their first home.

“Homeownership has for many years been an important part of the American dream, and if people feel like that’s slipping out of reach, we’re going to see that reflected in their attitudes about the election,” says Realtor.com® Chief Economist Danielle Hale.

“If people feel like the market itself is not able to meet their needs, then it’s not surprising to see them look to politics to try to find a solution,” she adds.

Biden’s proposals to boost affordability

Earlier this year, Biden used his State of the Union address to reveal an ambitious slate of proposals aimed at reducing housing costs. They included a two-year tax credit of $5,000 per year for first-time homebuyers, with a similar one-year $10,000 credit to those selling their first home to trade up.

“I know the cost of housing is so important to you,” Biden said during the annual address to a joint session of Congress. “If inflation keeps coming down, mortgage rates will come down as well. And the Fed acknowledges that, but I’m not waiting.”

Biden is also proposing various tax credits and spending programs that the administration says could finance the building or renovation of 2 million homes.

“Many of these proposals will need to make their way through Congress first—a particularly arduous task in an election year—though their inclusion in the address underscores the salience of the skyrocketing cost of housing for Americans nationwide,” Moody’s associate economist Nick Luettke wrote in a note on Biden’s speech. “Housing affordability has become a key issue for Americans spanning all demographics and political divides.”

However, Biden’s proposed tax credit for first-time homebuyers has come under scrutiny from some economists, who warn it could push home prices higher by turbocharging demand. Those critics warn that by subsidizing home purchases, the tax credits could draw more buyers into a market already struggling with low inventory, sparking bidding wars and price increases.

“I’m glad we’re having the policy discussion, but it seems like so many of the solutions offered by his administration are focused on the demand side, when supply side is where we need to really pick up steam,” says Nicholas Irwin, associate professor of economics and real estate at the University of Las Vegas.

“I don’t think by helping to subsidize the demand side, we’re going to fix the issue of house prices going up,” he adds. “We need to build more houses to account for the fact people want to live in houses.”

On the other hand, Biden’s proposed tax credit for sellers could boost available inventory by nudging homeowners to trade up, argues Alex F. Schwartz, a professor of urban policy at The New School and chair of the master’s program in public and urban policy at the university’s Milano School of Policy, Management, and Environment.

“This recognizes that there is sort of a logjam, with people who are not very interested in putting their house units on the market because of the fact that they’re at a very favorable interest rate, and they’re not going to be able to get that rate when they buy another unit,” he says of the tax credit for sellers. “So this would help lubricate that a bit.”

Trump’s scathing counterattack

Presumptive Republican nominee Trump, who first gained fame as a real estate tycoon, is veering in the opposite direction by claiming that Democrats’ efforts to boost home affordability amount to a “war on the suburbs.”

“The woke left is waging full-scale war on the suburbs, and their Marxist crusade is coming for your neighborhood, your tax dollars, your public safety, and your home,” Trump said in a recent campaign video. “They will use the power of the federal government to abolish zoning for single-family homes, destroy your property values by building giant multifamily apartment complexes in the suburbs, and even next to your house.”

Those comments echo Trump’s call to limit construction in the suburbs during his presidency, when housing affordability was also a smoldering problem.

According to Freddie Mac, the country’s housing shortage surged 52% during the 2018 to 2020 years of Trump’s term, reaching a shortfall of 3.8 million units.

“His record on housing has been abysmal. He is against fair housing,” says Schwartz, adding that he has difficulty taking Trump’s remarks on the subject seriously.

Trump’s rhetoric on housing seems aimed squarely at existing homeowners, designed to tap into fears that any effort to reduce housing costs for others will erode their own equity.

Those fears have long been powerful in driving anti-development attitudes, but are often irrational, argues Kenneth Chilton, an associate professor of public administration at Tennessee State University.

“The fear mongering is intense,” says Chilton. “If you’re living in a more affluent neighborhood, the price of land is such that, whatever units get built there to increase density, they’re not going to be cheap housing. That’s just because the price of the land kind of necessitates building more luxurious housing.

“Some of the research is starting to show that this movement toward higher density does not negatively impact property values. In fact, it can increase property values in certain neighborhoods,” he adds.

A more valid concern, says Chilton, would be the prospect of rising home values in working-class suburbs potentially pushing out middle-income buyers.

Two opposing messages for two different voting blocs

To be sure, housing is far from the only issue that voters will weigh before they cast their ballots in November. Foreign policy, the broader economy, immigration, and the personal qualities of the two candidates are also likely to be key issues, among other topics. But in a tight race that will be decided in a handful of swing states, home prices and affordability could play a key role.

Based on recent polling, housing affordability is a top concern for voters, but neither Democrats nor Republicans seem to hold a natural advantage on the issue. One national survey last month from the University of Michigan and the Financial Times found that concern about one’s own ability to afford housing was evenly distributed politically, with about 70% of Democrats, Republicans, and independents ranking that issue among their top concerns.

“Housing remains one of the few areas of bipartisan agreement, and poll results are consistent with what’s seen nationwide at the state and local levels,” says Brian Connolly, assistant professor at the University of Michigan’s Ross School of Business.

That suggests housing policy could be one of the few issues that offer both major presidential candidates the chance to win over independent voters. Representatives for the Biden and Trump campaigns did not respond to Realtor.com requests for comment, but their public remarks make their starkly opposed positions on housing policy clear.

Biden’s proposals, aimed at boosting home affordability, are designed to appeal most to renters and other aspiring first-time homeowners (and perhaps their parents and other loved ones who hope to see them buy their first home). Trump’s message, meanwhile, is targeted at homeowners who are perhaps most interested in seeing the value of their own homes continue to rise.

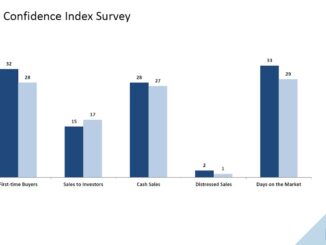

Based purely on demographics, Trump’s message might find a wider potential audience of likely voters.

Nationwide, the homeownership rate is about 66%. Homeowners are also more likely to vote than renters, according to a study from Apartment List. In the 2020 election, 55% of renters who were eligible to vote cast a ballot, compared with 71% of homeowners, the study found.

“There are various reasons for this disparity in political engagement, but a major one is simply property ownership,” the study authors wrote. “Homeowners have a large financial motivation to vote when they perceive that the policies at stake could impact local property values.”

On the other hand, when they do vote, renters are significantly more likely to vote Democratic than homeowners. Biden’s proposals could be aimed at mobilizing turnout from renters seeking to become first-time homebuyers, a constituency that historically heavily favors Democrats.

The Apartment List study found that in 2020, renters preferred Biden over Trump by a wide margin of 36.5 percentage points. Homeowners narrowly swung for Biden by just 0.6 points in that election, marking the first time a Democrat had won the majority of the homeowner vote since Bill Clinton in 1996.

Recent polling suggests that Biden is struggling with younger voters, traditionally a key Democratic constituency. His emphasis on making homeownership more affordable could be intended to energize those younger voters, who are more likely to be renters.

It remains to be seen whether Biden can boost turnout from renters without alienating homeowners, a balancing act that might prove tricky for the incumbent as he grapples with voter dissatisfaction over the current state of the housing market.

“The housing market is broken,” says Chilton. “There’s a lot of different potential reasons for that, but it’s just not functioning for people who don’t already own. And this is the first time in modern history, post World War II, that we’ve been in this situation.”

Real Estate – Latest NYC, US & Celebrity News