It is nearly April, which means temperatures in the Austin metropolitan area are heating up — and so is the housing market.

But like the temperatures, which are far from the triple-digit figures the residents of the Texas state capital will see in the coming months, local real estate professionals say that even though the market is warming up, it is nowhere near the frenzy at the height of the COVID-19 pandemic.

“The market is still strong,” said Wendy Cash, a broker at Austin area-based Century 21 Hellmann Stribling. “Buyers are still buying and sellers are still selling. We definitely noticed a downturn last year, which coincided with interest rates going up, and buyers just put the brakes on things and wanted to wait to see what was going to happen.

“When interest rates took a dig late in the fall, buyers came back out of the woodwork and started buying again. But I don’t thing we are ever going to see something like we did during the pandemic again.”

From 2020 until the middle of 2022, the Austin metro area was turning heads for its massive influx of homebuyers and its exponential home price growth. In early March 2020, prior to the onset of the pandemic, the 90-day average median list price for a single-family home in the area was $357,000. By late May 2022, this figure had risen to $650,000, according to data from Altos Research.

What ensued next was a rapid cooldown, which saw the median list price fall by more than $100,000 by mid-February 2023 to $533,000.

“April and May of 2022 is when we felt the first slowdown,” said Scott Michaels, an Austin-based Compass agent. “Looking at the number, 2023 was the lowest year in the past 28 years for sales, so it was a bit of an oddity compared to what we’d seen in the second half of 2020, all of 2021 and the first half of 2022.”

While Austin has made headlines in recent months for the number of homebuyers looking to move away from the metro area, local real estate professionals say that buyer demand remains strong.

“Interest rates have come down a little bit and kind of settled. We aren’t seeing the volatility we were, and I think that has made buyers a little more willing to make the leap and purchase a home,” Cash said. “Then, obviously, spring is kind of your traditional selling season, so there are more buyers typically in the spring, plus not as many people pulled the trigger last fall, so we have that pent-up demand.”

Michaels also noted that his business is still seeing a steady stream of out-of-town buyers.

“We are still seeing people move from all over the country, whether it is first-time or move-up buyers within Austin or people from Dallas, Houston, and then feeder markets like California, New York, Chicago, and we are seeing quite a few from the Seattle region right now,” Michaels said.

Agents highlight the stability of the Austin metro area’s median list price, which has hovered around $550,000 since early November 2023, as evidence of the still-strong level of demand in the market.

“Overall, things are kind of continuing from where they were in 2023 with a very modest change in the median sales price. And closed sales were also up about 1%, so overall just a little bit more of the same,” said Clare Losey, housing economist for the Austin Board of Realtors.

“What we saw during the COVID pandemic was just really unsustainable over a long-term basis. We had artificial demand that was induced by the pandemic itself — low interest rates, work from home, vacation homes — and it really drove demand that we otherwise would not have seen if the pandemic had not happened.”

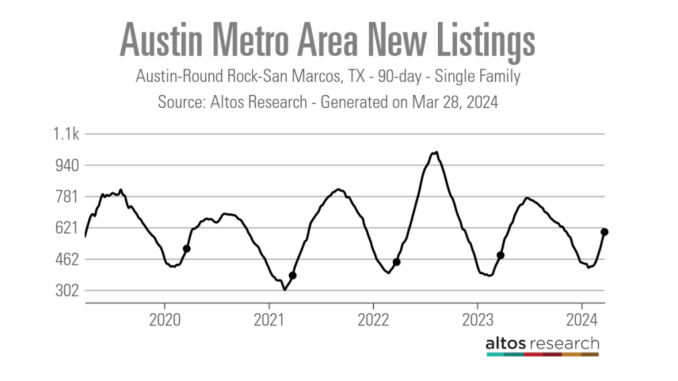

Additionally, Austin’s median list price has remained stable even as inventory has risen drastically from the troughs it reached in the spring months of 2021 and 2022.

As of March 22, 2024, the 90-day average median number of active single-family listings in the Austin metro area was 6,895 — up from an all-time low of 1,070 listings in April 2021. In November 2023, this figure actually surpassed its pre-pandemic level at 8,527 listings.

“I think we are pretty balanced,” Cash said. “Technically we are still in a seller’s market. I feel like the market we are in, from an inventory standpoint, feels similar to last year.”

According to Losey, much of the new inventory coming on the market in Austin is suitable for first-time homebuyers.

“It is going to be a more popular homebuying season for first-time buyers,” Losey said. “There is just more inventory on the market that is within the most affordable price range, meaning homes priced under $300,000. In February, we saw an overall uptick of 45% in new listings on a year-over-year basis, but we saw a 27% increase in homes prices under $300,000.”

Even with the uptick in inventory, agents say they are still seeing properties receive multiple offers and go for more than the asking price.

“I occasionally see houses go for over ask, but not like they did during the pandemic,” Cash said. “A house may go for $10,000 or $20,000 over, and the multiple offers are like two or three offers and not the 15 to 20 offers.”

Michaels added that properties in popular neighborhoods that are priced correctly are still going within the first week they hit the market.

“If you are in an area where there is more inventory on the market, it may tend to sit a little bit longer,” Michaels said. “If it is priced at a higher price point, it may also sit a bit longer because your buyer pool is smaller, so that is a challenge for more of the luxury properties that are going up.”

While the Austin housing market may have cooled down from its post-pandemic heyday, local professionals remain bullish about the future of their metro area and housing market.

“Austin is just one of the premier areas of the country where people want to live or relocate to for a variety of reasons,” Michaels said. “There is great job growth, it is a vibrant city, there are beautiful rolling hills, the lakes, but also people are just sick of sitting on the sidelines and waiting for a market shift. They’ve been waiting for almost two years now, so they are just ready to pull the trigger and make the jump, and we are here for them.”