The lack of affordable housing in the United States is well-documented in the nation’s urban markets, where it is contributing to the swelling ranks of the homeless.

That same dire need for affordable housing for the least prosperous among us, however, also is a serious problem in rural America — home to nearly 70 million Americans.

The U.S. Department of Agriculture (USDA) administers one of the main programs providing housing for low-income households in the rural stretches of this country — where an estimated 7.9 million people live in what Freddie Mac defines as “persistent poverty” counties.

This USDA program, however, is in serious trouble. It now faces a wave of mortgage maturities and payoffs on the thousands of affordable-housing complexes it has helped to finance over the years — with no new construction carried out under the program since 2012 .

After those government-supported mortgages terminate due to maturity or prepayment, the owners can, and many do, convert their multifamily properties to market-rate rents, or sell them to new owners that are not committed to providing housing that is affordable to struggling low-income rural tenants.

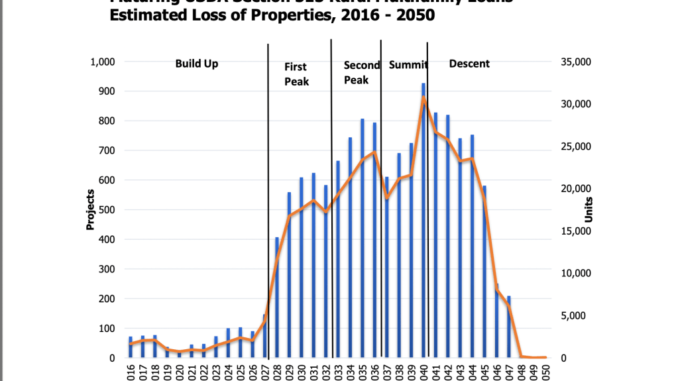

In fact, if nothing is done, this USDA program — called Section 515 — is projected to lose up to 137,000 affordable-housing units between 2023 to 2033 nationwide due to mortgage maturities alone, according to USDA projections, “with a potential to lose approximately 333,000 units by the year 2050.” USDA estimates that there are now a total of about 12,500 Section 515 multifamily properties of varying sizes nationwide.

Credit: Housing Assistance Council

Those figures, however, are expected to be accelerated and magnified by early loan payoffs as well — with some 40% of the properties in the Section 515 portfolio having mortgage prepayment rights, according to the nonprofit Housing Assistance Council (HAC). (Using a slightly different yardstick than USDA, HAC estimated in a 2018 report that Section 515 loan maturities will reach 191,607 units between 2016 to 2036 — and 416,396 units between 2016 and 2050.)

About 533,000 units of Section 515 rental housing have been created nationwide since the program was launched in 1963, according to Natalie Maxwell, managing attorney at the National Housing Law Project (NHLP). HAC estimates there are now fewer than 400,000 Section 515 rental units remaining nationwide.

“I would argue we’re past the last minute for addressing this problem, at least for an estimated 140,000 or so families who now don’t have access to affordable Section 515 housing due to properties that have already left the program since it was started,” said David Lipsetz, president and CEO of HAC.

Those impacted by the shrinking Section 515 housing portfolio, most of whom also receive rental assistance via USDA programs tied to Section 515, have an average household income of about $13,000.

Hidden homeless

Chris Potterpin is president of development at Michigan-based PK Companies LLC, whichdevelops, owns, and manages some 5,200 units of affordable and market-rate housing throughout the Midwest, Texas, and California. Of the company’s total portfolio of 115 properties, 85 have been financed through the USDA’s Section 515 affordable-housing program — which offers 30-year mortgage financing, often amortized over 50 years, at a 1% interest rate.

Credit: Housing Assistance Council

Given Section 515 has not provided mortgage financing for construction of new multifamily affordable-housing projects in more than a decade, Potterpin said efforts under the USDA program are now focused primarily on providing rental assistance.

He added that funding for new affordable-housing construction generally, as well as funding for preservation of existing Section 515 properties — most now several decades old or more — is currently dependent on the Low-Income Housing Tax Credit (LIHTC) program.

The LIHTC program, administered through the U.S. Treasury Department and state housing finance agencies, however, is extremely competitive and complex to navigate, which means a lot of small “mom-and-pop” investment property owners simply “don’t have the capacity or the complexity to go chase those tax credits,” Potterpin said.

“We are one of the more active owners [Section 515 properties], and we spend a lot of time preserving our properties with tax credits, or other sources,” he said. “…The biggest demographic [in our properties] are the elderly, the disabled and single moms.

“We’re usually the only affordable deal in town because these are small towns, and there’s not a lot of other options,” Potterpin added. “So, [if tenants lose Section 515 housing) they have to move in with family, move in with friends or have to relocate, or maybe they have to live in a tent in the woods.”

Credit: Housing Assistance Council

Lipsetz, president and CEO of HAC, an affordable-housing advocate as well as a certified Community Development Financial Institution, adds that none of the outcomes are good if this issue of the slow bleed-out of the Section 515 program is not addressed.

“Some [of these people] will end up homeless or living in a dilapidated housing, [a car, a camper] or maybe attempt to stay in the same unit where their rent is now more expensive [after the affordable-rent support lapses) and they really can’t make it work … and some will die,” he said. “If we let certain parts of our society bear the brunt of the challenging economy, then we’re dooming ourselves to continue to have poverty live in this rich country and to continue to have all the civic challenges that come with that.”

Lance George, director of research and information at HAC, explained that the multifamily properties that are exiting the Section 515 program are doing so for a variety of reasons, but he identified two as most pronounced.

“One bucket is properties that are closer to metropolitan areas where the owner could easily convert [to a market-rate property] for higher rents,” he said.

The other bucket, he said, involves property owners who are smaller operators and are aging, or maybe hoping to pass their properties onto their children, and they or their kids “don’t want to deal with the government anymore.”

“And they say, “To hell with it, we’re just going to get rid it [the property],’” George added.

So, they prepay the mortgage and sell the property, or sell it once the mortgage matures.

“A concern with the tenants forced to leave these projects is that they are at imminent risk of homelessness, or alternatively, if they’re elderly they may be institutionalized,” said Jonathan Harwitz, director of public policy at HAC. “…They then become part of what in rural America is known as the hidden homeless.”

The fixes

The world often looks darkest just before the dawn, however. In the case of USDA’s Section 515, the program may soon get a glimpse of that sunshine in the form of rare bipartisan legislation, packaged under the Rural Housing Service Reform Act (RHSRA), that is now pending in Congress.

Efforts are now underway to attach that legislation to the omnibus Farm Bill up for renewal this year, according to Harwitz at HAC — who served previously as deputy chief of staff for the U.S. Department of Housing and Urban Development and more recently as director of housing community development and insurance policy for the House Financial Services Committee.

The legislation would provide several tools to help stem the loss of Section 515 affordable-housing in rural America. Chief among them is decoupling a key rental-assistance program, known as Section 521, from the Section 515 mortgages.

Some 80% of the tenants of Section 515 properties receive Section 521 rental assistance to ensure that no more than 30% of their monthly income goes to housing costs, according to USDA. The problem currently is that Section 521 rental assistance is tied to the Section 515 mortgage, so that once the mortgage matures or is otherwise terminated, the rental assistance also goes away as well.

The RHSRA seeks to fix the problem by decoupling the two programs, so that once a Section 521 mortgage matures or otherwise is paid off, the Section 521 rental assistance can continue, assuming the property owner is willing to keep project rents affordable with continued USDA oversight.

“The decoupling is one piece [of the proposed reforms], and it’s really a critical piece because the section 521 Rental Assistance Program is what makes the 515 properties affordable to the lowest income folks,” explained NHLP’s Maxwell. In addition, Harwitz of HAC said decoupling will allow project owners to “bring in other sources of financing” because of the cash-flow security provided by the government-backed rental-income support.

“But it’s not sufficient in and of itself,” Harwitz adds. “We also need more funding for the multifamily preservation program.

“But just to be clear, there’s no expectation that the Farm Bill [via an attached RHSRA) will spend money on housing. Decoupling is a no-cost intervention, and a very clear stipulation of the ag people [USDA] is that they’re willing to carry policy but not costs.”

Another part of the fix proposed via RHSRA is making it easier for nonprofit, mission-driven organizations to acquire Section 521 properties from for-profit owners seeking to sell once their mortgages have matured or been prepaid.

“The nonprofit transfer piece is critical,” Harwitz said. “USDA has a program to do that, but it has not been the easiest.

“So, we see decoupling as also tied to the department improving the ability of nonprofits at the point of [mortgage] prepayment or mortgage maturity to be able to acquire these properties.”

Finally, another major fix proposed via RHSRA is expanding the range of another key rental-assistance program serving low-income rural households, which is known as the Section 542 rural housing voucher. Currently, such vouchers offer a fixed rental subsidy that is available to tenants in cases where the Section 521 mortgage is prepaid but not when the mortgage matures or in the case of a foreclosure.

In a statement provided to Congress last year, HAC’s Lipsetz described the proposed reform as follows:

“Under the current appropriations, the … Section 542 rural housing voucher subsidy is set at the time of [mortgage] prepayment and never changes as rents increase or household income decreases,” he wrote. “As a result, voucher holders face displacement from their housing if they have a loss of income or their rents are increased.

“This bill [RHSRA] addresses this issue by allowing the value of a voucher to be adjusted over time. Additionally, it allows tenants in properties whose mortgages are maturing or being foreclosed on to access vouchers, in addition to those in properties that are prepaying.

Maxwell added that the reform will offer Section 521 tenants “mobility,” so that if someone want to move elsewhere, the rental voucher follows them.

“The thing about decoupling Section 521 rental assistance is that really is a decision that’s going to be up to the current owner of the property,” she explained. “So, if the owner decides that they want to continue with the [521] rental-assistance program [and meet USDA affordable-rent requirements], then the tenants would be protected.

“But if that owner decides that they do not want to continue with the [Section 521] rental-assistance program, and they go ahead and pay off the mortgage, that’s where the [Section 542] voucher becomes critical, either for tenants seeking to remain where they’re at or if they want to take that voucher someplace else.”

New construction

The elephant in the room that is not on the table of reform currently, however, is the dearth of new housing financed through USDA’s Section 521 program — which has not been used to fund new affordable-housing projects since 2012. It’s not enough to slow the runoff of properties in the program, or to simply preserve the existing housing stock, though that is important, too, according to policy experts.

“I think in a healthy housing market, you have to have both new construction and preservation efforts,” Maxwell said. “We would like to see Section 515 paying for both.

“Not all of these properties are not going to be preservable because financially they may not be able to make the deals work, and all of them are not in the same condition. In order to maintain affordable rentals in rural communities long-term, there does have to be some new construction, and there’s no reason why the LIHTC [tax credit-based] financing cannot be paired with Section 515 funding to promote new construction.”

Potterpin of PK Companies offers a warning for the future of Section 521 if the program continues down a path of being underfunded and hyper-regulated.

“It has become increasingly onerous to manage [properties] within the program, whether it’s additional regulatory complications or just the lack of capital available,” he said. “So, without new incentives, without additional capital, you’re going to see a major shrinking of this portfolio, and you’re going to lose a lot of units.”

Despite the challenges, however, Lipsetz chooses to remain optimistic that the path ahead leads to a better place for rural affordable housing.

“When I think of housing, I think of a place where our workers and our families and our parents live,” he said. “I think of that housing as infrastructure that’s going to serve generations of grandmas.

“And I do I do believe that our civic public-sector has shown the ability to knit the country together and to really raise the prospects of those who are not well-served by the economy. I feel like we have a public sector that can do that, and to accept that as a totally legitimate role in a society like this … great, let’s do that.”