After a few months of downward data in its performance metrics, the reverse mortgage industry saw a slightly different story play out in March that should come as welcome news.

Home Equity Conversion Mortgage (HECM) endorsements increased 8.3% to 2,058 loans in March, an increase helped by new case numbers and slightly telegraphed by recent industry sentiments, according to data compiled by Reverse Market Insight (RMI).

HECM-backed Securities (HMBS) issuance also recorded stronger performance in March, rising to $447 million. That was up $18 million from the $429 million figure in February, according to Ginnie Mae data and private data compiled by New View Advisors, who characterized the jump as a “spring ahead.”

HECM volume and case numbers

Six of the 10 tracked geographic regions recorded HECM volume increases according to RMI, but the losses in the other four regions ranged from nine to 12 loans, making them modest. But case numbers are a strong indicator of future industry performance, and new case number data for February performed strongly, RMI said.

“Even more importantly (in terms of future volumes), we also saw February case numbers issued rise 10.6% to 3,237,” according to the commentary accompanying RMI’s March data.

In terms of the tracked regions, the Northwest/Alaska region led the way in terms of biggest relative improvement, rising 23% to 166 loans. The Rocky Mountain region rose 17.1% to 185 loans, while the Southwest increased 15% to 230 loans.

Six of the top 10 lenders in the space also posted gains, according to RMI. The gains were led by Guild Mortgage (rising 96.6% to 57 loans); Goodlife Home Loans (26.2% to 82 loans) and Liberty Reverse Mortgage (rising 25.4% to 84 loans), respectively.

Open Mortgage remains in the top 10 rankings despite not having endorsed any HECM loans since January. Late last year, the company announced it was exiting the reverse mortgage space, but due to its status as a leading lender at the time it will naturally work itself out of a top 10 position over the next several months.

Looking ahead

When asked about what these numbers could mean for the industry in the immediate future, RMI President John Lunde said it’s dependent on the pace of case numbers and whether or not it can be maintained.

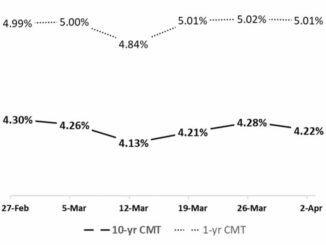

“[These numbers translate to] steady progress in both endorsements and case numbers issued,” he said. “The key will be watching to see if this continues in light of the slow upward grind in the 10 year [constant maturity treasury (CMT) rate] so far this year.”

When asked about the case numbers, Lunde explained that he is “definitely” encouraged by the increase seen there, especially considering the way last year ended up shaking out.

“The end of 2023 was very weak on this measure, so good to see some recovery signs here,” he said.

The actual breakout of numbers also paints a telling picture, since March saw new borrower (or “equity takeout”) originations rise by 10.7%, HECM for Purchase (H4P) endorsements increase by 15.1% and even HECM-to-HECM refinances jump by 8.8%.

When asked about how purchase business could play out for the rest of the year, Lunde said he is hopeful.

“I’m optimistic on H4P, more so than in the past several years simply due to the change in seller concession rules to simplify the process [to be] more like forward,” he said. “The less friction in comparing forward versus reverse purchase loan options, the better it will be for H4P as there really are great advantages to the product for this use case.”

HECM-to-HECM (H2H) refis are a recent sore point for the industry, however, since the loss of the refi market in 2022 led to a post-pandemic drop in total industry endorsement activity. The refi opportunity may be smaller, but it’s still present, Lunde said.

“It’s inevitable that some originators will focus on the smaller opportunity in H2H because it’s a clearer path from marketing to closing table,” he explained. “I’d say check in with your past customers if they can benefit, but otherwise keep focused on the much larger opportunities in H4P and other new customers.”

HMBS issuance

HMBS issuance improved in March, but the issuance figures still remain close to the historic lows of the HMBS program’s earliest days seen in 2009 and prior according to New View. However, despite that — and issuing 79 pools in March compared to February’s 80 — the metric still managed to increase for the month by $18 million.

The HMBS issuance record set in 2022 is in no danger of being broken, much less broached in 2024.

“HMBS issuance set a record in 2022, with nearly $14 billion issued,” New View said. “Total issuance for 2023 was less than half, at $6.5 billion. 2024 is not off to a good start with total issuance through March totaling just $1.3 billion – $151 million and $2.76 billion lower than at this time in 2023 and 2022, respectively.”

When asked how realistic it is for 2024 issuance to outpace 2023’s, New View Partner Michael McCully said it’s not looking likely.

Volume is interest rate driven; the 10-year [CMT] is at 4.42% today,” he said. “The 10-year was sub-4% in early January, which may explain the tick up in volume 60 days later. The current backup in rates does not bode well for 2024 volume.”

When asked about an uptick in refinance volume, McCully said that it is part of the industry’s posture.

“Investors in reverse mortgage securities will forever be watching for any pickup in refinance activity,” he said. “This is the new normal for our products.”

But first participation pool production modestly increased in March by $4 million, rising to $268 million. Also continuing to serve as a positive sign for the HMBS market broadly is the addition of pools with aggregate pool sizes of less than $1 million, stemming from a policy change made last year by Ginnie Mae.

“Issuers are taking advantage of Ginnie Mae’s provision to issue pools as small as $250,000,” New View said. “This represents $14.7 million of UPB that may not otherwise have been issued in March.”