San Francisco, once the crown jewel of the West Coast, is now teetering on the brink of collapse — and it seems like nobody is sounding the alarm.

The city’s housing market, in particular, has been hit hard over the past year, with prices plummeting and homeowners fleeing in droves.

JPMorgan Chase CEO Jamie Dimon didn’t mince words when he compared San Francisco’s woes to those of New York City, calling the Bay Area “in far worse shape.”

“I think every city, like every country, should be thinking about what makes an attractive city,” Dimon told Maria Bartiromo in an interview on Fox Business.

“It’s parks, it’s art, but it’s definitely safety, it’s jobs and job creation, it’s the ability to have affordable housing. Any city that doesn’t do a good job will lose its population.”

San Francisco is failing on all fronts and in turn, its housing market is quietly crashing.

Once-luxurious properties are now listing and selling for massive discounts just to attract buyers.

Consider the penthouse at the San Francisco Four Seasons Residential, initially listed in November 2020 for $9.9 million, now begging for buyers at $3.75 million — a jaw-dropping 62% markdown.

It remains on the market today.

Homeowners desperate to escape the sinking ship are offloading their properties at losses, with many seeing their investments dwindle by hundreds of thousands of dollars in just months.

A five-bedroom home at 478-480 Fourth Ave. sold for $1.1 million earlier this month, after selling less than a year prior for $1.6 million.

At 88 King St., a two-bedroom condo overlooking a ball park that sold for $1.12 million more than a decade ago in 2014, recently sold last month for $1.08 million.

Another two-bedroom condo at 1075 Market St., which sold in 2019 for $1.25 million just traded hands earlier this month for $675,000 — and after a price cut, to boot.

The broader trend, according to the latest Redfin analysis, is stark. Nearly one in five homeowners in San Francisco are selling their homes for a loss.

Another one among them: A rare home overlooking the Golden Gate Bridge with oceanfront views was initially listed for the first time in nearly 35 years last March for a price of $12.8 million.

After several price cuts, it took a year to sell at the fairly modest price tag $7.85 million for the area.

The commercial sector isn’t faring any better, with office vacancies soaring post-pandemic.

And the desperation is palpable, as evidenced by the recent sale of a property on Market Street at a mind-boggling 90% discount.

The building at 995 Market St. was acquired for just $6.5 million during a public auction last week.

The previous owner had paid $62 million for it in 2018.

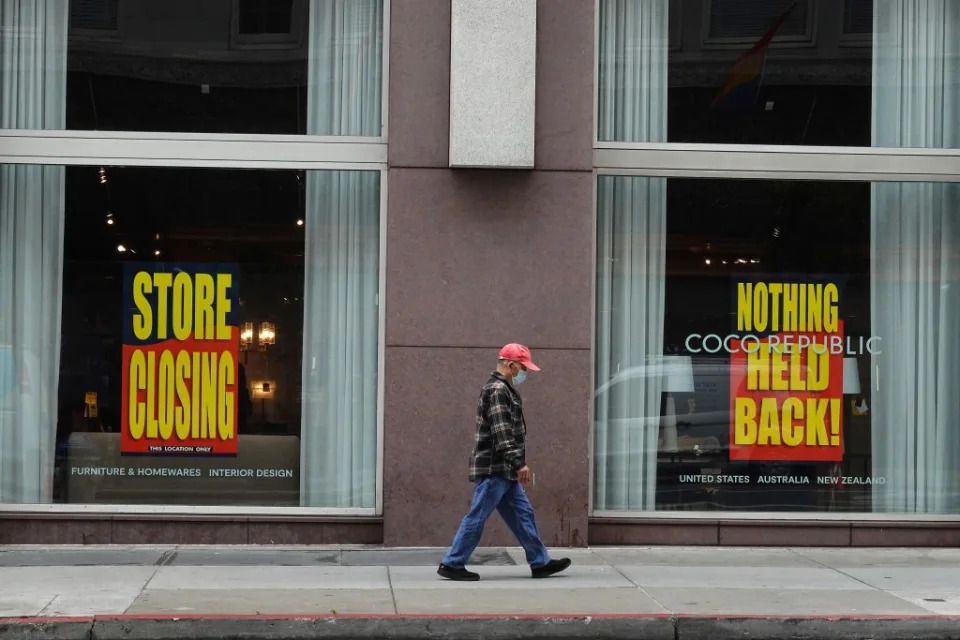

Even retail giants are abandoning ship.

In February, Macy’s announced that it was closing its massive flagship store in San Francisco’s Union Square.

The year prior, Nordstrom had announced it was closing two of its stores over the “deteriorating situation in the area.”

The mall had been inundated with fentanyl overdoses, drug dealers and thieves.

Real estate veteran Craig Ackerman, who’s witnessed San Francisco’s rise and fall over three decades, laments the city’s potential squandered by inept leadership.

He predicts years of continued mismanagement unless drastic changes are made. However, with the current administration’s penchant for liberal grandstanding over pragmatic solutions, the outlook remains grim.

“I do think that San Francisco probably has another five to eight years of mismanagement. I mean things are a mess out here and they don’t need to be. This could all be changed by the stroke of a pen,” Ackerman told The Post.

“But the mayor — they choose to continue this ridiculousness.”

“I don’t think it’s going to change,” Ackerman added.

“They are happy waving their liberal flags and looking for a fantasy land that doesn’t exist … It’ll kill you on the way there.”