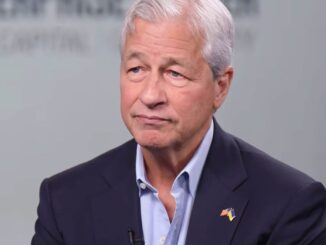

Jamie Dimon evidently believes in the KISS principle when it comes to mortgage — keep it simple, stupid.

In his annual letter to shareholders, the influential head of JPMorgan Chase wrote that “we can fix the housing and mortgage” markets.

“For example, mortgage regulations around origination, servicing and securitization could be simplified, without increasing risk, in a way that would reduce the average mortgage by 70 or 80 basis points,” he wrote. “The Urban Institute estimates that a reduction like this would increase mortgage originations by 1 million per year and help lower-income households, in particular, buy their first home, thereby starting them on the best way to build household net worth.”

He suggested a “candid review” of the thousands of new rules passed since Dodd-Frank.

“After this review, we should ask what is it that we really want: Do we want to try to eliminate the possibility of bank runs? Do we want to change and create liquidity rules that would essentially back most uninsured deposits? Do we want the mortgage business and leveraged lending business to be inside or outside the banking system? Do we want products that are inside and outside the banking system to be regulated the same way? Do we want to reasonably give smaller banks a leg up in purchasing a failing bank?”

While Dodd-Frank did some good things, shouldn’t we take a look at the huge overlapping jurisdictions of various regulators? This overlap creates difficulties, not only for banks, but for the regulators, too. Any and all of this is achievable, and, I believe, could be accomplished with simpler rules and guidelines and without stifling our critical banking system.”

If Biden is reelected, it seems more likely that there will be increased regulation in the housing and mortgage industries, not less.

In just the last year, the Department of Justice has called for a full dislocation of real estate commissions between sellers and buyers, and special committees have been set up to reimagine appraisals. Meanwhile, the Consumer Financial Protection Bureau is apparently targeting ‘junk fees’ in mortgage origination and borrower-paid title insurance and the Federal Housing Finance Agency adds new requirements of counterparties in its Duty to Serve plans and tweaks to the LLPAs. On the capital markets front, banks and warehouse lenders are looking at new potential capital requirements stemming from wholesale changes to Basel III.

On Basel III endgame rules, Dimon said the proposals would make mortgages and small business loans more expensive. “Consumers seeking a mortgage — including first-time homebuyers and historically underserved, low- to moderate-income borrowers with smaller down payments — will face higher interest rates or will have a tougher time accessing one,” he wrote. “This will occur not only because the cost of originating and holding these loans is higher but also because the cost of securitizing them will rise for banks, nonbanks and government agencies.”