Last week was a pretty strong week for all the housing numbers. New supply and sales numbers keep climbing — both weekly and over last year. Home prices had a slight increase this week across the board.

What does this means for home prices this spring?

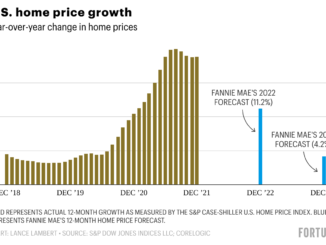

As the data comes in each week this year, I’ve been more optimistic about home sales volume growth than for home-price growth. Specifically, when housing inventory is 25% greater than a year ago, the supply/demand balance is obviously very different than it has been. And that implies softness for future sales prices. So while we can see currently the prices of home sales holding up, the signals for the end of 2024 and into 2025 seem to suggest we’re heading for flat home prices.

In addition, we can see the price reductions ticking up each week. They aren’t at a scary level, people are buying homes, but it’s notably softer on pricing than last year at this time.

Mortgage rates seem to have finally settled down. The Fed met last week and we escaped dramatic changes in the markets. I was worried that we might come out of that meeting with a spike in mortgage rates but that didn’t materialize so we got lucky.

I like to point out that consumers are more sensitive to changes in mortgage rates than to the absolute levels, and since rates are now basically unchanged for the month, just easing down from the early March peak of 7.2%, sellers and buyers are tip-toeing back into the market.

As a result, we continue to see the signals that home sales volume will grow this year and prices will be mostly flat. The price appreciation signals last year were stronger than they are now.

Housing inventory

The available inventory of unsold homes continued to climb last week.

There are now 513,000 single family homes unsold on the market.

That’s 1.1% more than last week and 24% more than a year ago.

Last year, inventory was still declining in March. Now it’s on the rise.

Inventory will cross over 2020 levels by July. We’ll finish the year with over 600,000 homes on the market unless rates reverse and fall quickly.

Three takeaways from the inventory data now:

1. Growing inventory this year means more sales can happen. More sellers means more sales will happen.

2. Year-over-year inventory growth points to weaker demand and is one of the signals that home prices won’t climb this year. We currently have 24% more homes on the market than a year ago.

3. The longer mortgage rates stay higher, the more inventory will grow closer to the old levels. If you’re a homebuyer and you’re waiting for mortgage rates to fall before you swoop in for a deal, recognize that even slightly lower rates will spur demand more than supply so inventory will start falling and selection and competition will be worse.

New listings

Each week this spring we’ve been tracking the new listings volume. Last week we saw just over 60,000 new listings added to the inventory with another 17,000 new listings / immediate sales. In total, new listings data is 14% more than last year. April is looking good for home sales growth.

A year with 5.5 to 6 million home sales would need probably 80,000 new listings of single family homes right now. And we have 60,000, so there simply aren’t enough homes for sale to hit the big sales numbers, but the lid is being lifted. We can see obvious growth.

Pendings

As supply increases, the rate of sales is starting to pick up compared to a year ago. We can measure home sales in real time by tracking all the homes that moved to contract pending status this week. These “pendings” aren’t yet sold. They’ll spend 30 or 40 days in contract and the sales will mostly close in April or May.

There were 67,000 new contracts for single family homes this week compared to only 62,000 in the same week last year. There were another 15,000 condos into contract. This annualizes to only 4.3 million home sales, without any seasonal adjustment. So obviously the rate of sales is still pretty slow, which makes sense given the high mortgage rates. But the sales rate is climbing. The rate of new contracts is 8% more than last year but still 15% fewer than March of 2022, when buyers were desperately trying to get their deals done as rates were rising.

It looks like April will see decent home sales growth over 2023 but won’t overtake 2022 sales volumes until after July of this year. July of 2022 was when supply and demand fell precipitously. If mortgage rates stay stabilized in the upper 6s, these trends look durable to me.

Home prices

Last week, all the current price measures actually had pretty healthy gains. When we look at all the homes on the market, the median price is now $439,000. That is up a fraction this week and just a little bit higher than last year. Home prices climb this time of year before peaking in June as the best inventory, the most new listings, and the best demand is in the market. This week’s price increase is right in the normal range for the end of March.

The price of new listings took a healthy jump this week, up 1% to $424,900. That’s nearly 4% higher than a year ago. It’s also to be expected that the price of new listings each week in the spring lurch higher. There is no signal of big home price changes in this leading indicator, but it’s nice that this move is up.

Four years ago in March 2022, we were at the start of the pandemic lockdown and we could see the price of the new listings drop very quickly. That price decline only last for three weeks though. And the price of the new listings was one of the important factors that showed us very quickly how there would be no housing crash as a result of the crisis.

The price of the homes going into contract across the country are holding up but also not accelerating. The median price of the new contracts this week was $389,900 — that’s up a fraction from last week and 4% more than a year ago. Home prices peaked in May of 2022 and didn’t surpass that during last year’s spring season. I expect we’ll hit new all-time highs for home prices in the next month or so, assuming these current trends hold.

Price reductions

Most of the signals in the data last week were pretty optimistic. If there is one factor to temper than optimism, it’s the price reductions. The percent of homes on the market with price cuts from their original list price ticked up to 31.4% this week. There are more homes on the market now that have felt the need to reduce asking price than there were a year ago. Last year’s market strength in Q1 and Q2 led to 5% home-price growth for the full year of 2023. We have less strength in pricing now than we did last year.

While price reductions are in the “normal” range, they are higher now than any March in many years. There are more sellers now who have reduced the asking prices on their homes than in any March in over a decade. This last decade was a very strong one for homebuyer demand, so we haven’t seen a “normal” market in a very long time.

This is a signal to pay attention to. It’s hard to see how home prices will grow nationally this year under these circumstances. We can see buyers in the market, but there is no signal of them pushing home prices higher. Sellers who over-price are being forced to reduce.

In March 2022, there were still very few overall homes with price reductions, but that was changing rapidly. The slope started to climb very quickly, especially in April and May of that year. The number peaked in November 2022 with 43% of the homes on the market needing price cuts. That November peak corresponded to home sales price declines four to six months later. That’s why this data is worth watching so closely: These price cuts tell us about demand now, which turns into sales several months down the road.

We can see homebuyers are very sensitive to mortgage rate moves. We can see the price reductions data adjust exactly in the moments that mortgage rates jump higher.