The median down payment for U.S. homebuyers in February was $55,640, according to new data report from Redfin (NASDAQ: RDFN). This marks a 24.1% upswing from $44,850 one year earlier, which is the largest annual percentage increase since April 2022.

Home prices rose 6.6% year-over-year in February, which Redfin attributed to this spike. The typical homebuyer’s down payment last month was equal to 15% of the purchase price, up from 10% in February 2023.

Las Vegas recorded the largest median down payment in the metros analyzed by Redfin, with a 60.9% upswing year-over-year. In San Francisco, the median down payment was equal to 25% of the purchase price, which was the highest among the analyzed metros. Down payment percentages were lowest in Virginia Beach (1.8%), Detroit (5%), Pittsburgh (5%), Baltimore (5%) and Philadelphia (7.3%).

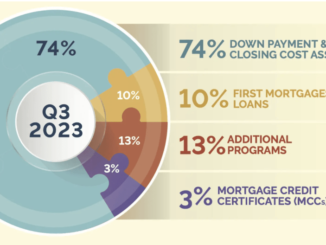

Redfin also reported more than one-third of purchases from February (34.5%) were all-cash transactions, up from 33.4% one year earlier. However, most all-cash transactions come from investors and not first-time buyers. And while more than three-quarters (77.5%) of mortgaged transactions involved conventional loans, roughly one in six (15.5%) mortgaged home sales used an FHA loan in February – up from 14.9% a year earlier.

“High mortgage rates are widening the wealth gap between people of different races, generations and income levels,” said Redfin Economics Research Lead Chen Zhao. “They’ve added fuel to the fire lit by surging home prices during the pandemic, creating a reality where in many places, wealthy Americans are the only ones who can afford to buy homes. Meanwhile, people who are priced out of homeownership are missing out on a major wealth building opportunity, which could have financial implications for their children and even their children’s children.”