Federal Reserve Chair Jerome Powell reiterated Wednesday that the central bank won’t be applying any cuts to benchmark interest rates until it’s sure that inflation is under control.

In his prepared testimony to the House Financial Services Committee, Powell hinted at rate cuts “at some point this year” but kept the timing under wraps.

Powell emphasized the Fed’s commitment to its dual mandate of bolstering employment and keeping consumer prices stable. While inflation has been running above the Fed’s 2% target, it showed signs of easing in 2023 without significantly affecting the unemployment rate.

Since the middle of 2023, payroll gains have averaged 239,000 jobs per month and the unemployment rate has remained near historic lows, standing at 3.7% in January.

Looking at the resilient economy and strong labor market, the Fed sees no urgency to cut rates just yet. Powell stressed that the Fed needs more assurance that inflation is on a sustainable path toward its target before making any moves.

“The committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%,” Powell said in prepared remarks.

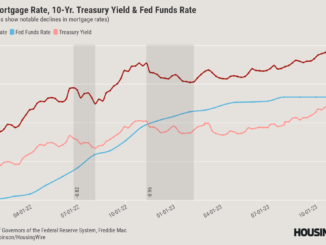

Since 2022, the Fed has been tightening its stance on monetary policy, but it has held the federal funds rate steady at 5.25 to 5.5% since its July 2023 meeting.

The Fed chief will be on Capitol Hill until Thursday for his semiannual monetary policy testimony. He is scheduled to appear before the Senate Banking Committee tomorrow.